Cathie Wood has become a popular investment manager to watch. She invests in disruptive tech stocks through her company, Ark Invest, and the exchange-traded funds (ETFs) it sells.

Last week, Ark sold shares of adtech company The Trade Desk (NASDAQ: TTD). Should investors follow suit?

All about The Trade Desk

The Trade Desk is a digital platform that connects advertisers and media outlets. It’s really as simple as that, although it uses artificial intelligence (AI) and top technology to match brands with media, leading to pinpoint accuracy and real results for users. It’s become a powerhouse technology company that offers valuable services supported by a huge and growing data load.

The company’s revenue has increased by a breathtaking compound annual growth rate (CAGR) of 42.6% during the past eight years, including 23% last year. This is a no-brainer service for the ad industry, and advertisers will continue to need it.

Why was Cathie Wood selling shares?

There wasn’t any particular news about The Trade Desk last week, and the stock didn’t make any notable movements. But there are many reasons she might have sold.

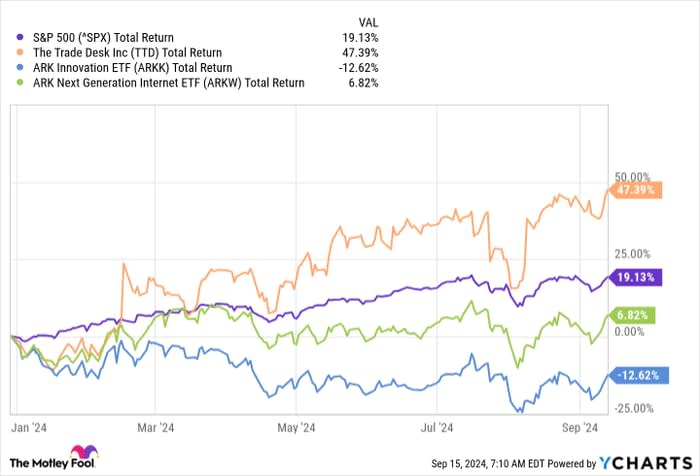

The stock is already up 47% this year, and it’s getting close to its previous highs from 2021. She might have wanted to take her gains. It could be that there are other stocks she sees as better deals, and she wants the cash to buy them instead. My hunch is that aside from that, The Trade Desk might be too mainstream at this point and not disruptive enough to meet her standards.

However, the market isn’t agreeing with her. Consider how the Trade Desk stock is performing compared with the two Cathie Wood ETFs that feature it, the flagship Ark Innovation ETF (NYSEMKT: ARKK) and Ark Next Generation Internet ETF (NYSEMKT: ARKW), and the S&P 500.

Does Cathie Wood know something investors don’t know? Could be. But if anything, there could be tailwinds coming very soon that will boost business. The Federal Reserve is meeting this week and has hinted broadly that it will cut interest rates for the first time since 2020.

Cathie Wood hasn’t lost all faith in the company. Ark Innovation still owns 945,864 shares, and Ark Next Gen Internet owns 266,875 shares. That’s why I think there’s a combination of factors here, led by the feeling that there are newer, flashier, more disruptive stocks on Ark’s radar.

Is Cathie Wood getting it wrong?

Something else to note about The Trade Desk — it’s wildly expensive. The shares trade at a P/E ratio of 210 and a price-to-free-cash-flow ratio of 110. However, its forward P/E ratio is 56. That’s not cheap.

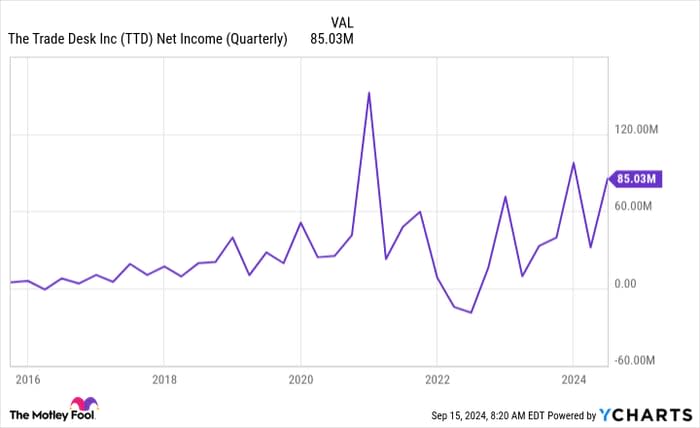

Here’s what it means. The Trade Desk was subject to considerable pressure when inflation took off two years ago. Advertisers immediately curtailed their spending, and The Trade Desk reported a quarterly net loss for the first time as a public company.

TTD Net Income (Quarterly) data by YCharts

What typically happens in a case like this is that the stock tanks, and that’s what happened to the market at the beginning of 2022. But The Trade Desk stock bounced back fast as it quickly returned to positive and growing earnings.

It reported $0.36 in earnings per share (EPS) last year as it recovered, but analysts are expecting $1.61 this year. That’s a huge jump. The high valuation implies that investors are also confident in The Trade Desk’s profitability prospects, even though it’s got two more quarters to report this year. It also explains why the forward P/E ratio is drastically lower. Analysts expect the company to keep this up and are shooting for $1.90 in 2025 EPS.

The Trade Desk’s business has been closely tied to the broader economy, and as the Fed gets ready to cut interest rates, it should benefit in a big way. It’s chasing a $900 billion market opportunity that’s only growing, and it has just a fraction of that right now.

There’s no way to know for sure why Cathie Wood is selling, but if you’re a long-term investor looking for a solid stock, definitely consider buying The Trade Desk.

Should you invest $1,000 in The Trade Desk right now?

Before you buy stock in The Trade Desk, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and The Trade Desk wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $729,857!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 16, 2024

Jennifer Saibil has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends The Trade Desk. The Motley Fool has a disclosure policy.