Following a terrific start to the year, Super Micro Computer‘s (NASDAQ: SMCI) stock chart has undergone a stark reversal over the past six months. It has lost close to 60% of its value from its peak, and recent developments seem to have further dented investor confidence in the company.

First, the fiscal 2024 fourth-quarter results it released on Aug. 6 weren’t up to Wall Street’s expectations, and management’s guidance was disappointing. Second, short-seller Hindenburg Research released a report alleging accounting irregularities at Supermicro. Then, Supermicro management announced that it was delaying the filing of its annual report, which only added to the negative press.

Those factors explain why Wall Street analysts have been downgrading the stock lately. But given that shares of this server and storage systems manufacturer are now trading at an attractive 22 times trailing earnings and 13 times forward earnings, opportunistic investors may be tempted to buy Supermicro. Should they be doing that in light of the recent developments?

Addressing the elephant in the room

Investors should note that Hindenburg is a short-seller, and it has a financial interest in seeing Supermicro’s stock price fall. In that context, we cannot be sure that the allegations that Hindenburg is making are valid, especially considering that the short-seller has been wrong in the past. That said, Supermicro was charged by the Securities and Exchange Commission (SEC) for accounting violations in August 2020, when it was found to have prematurely recognized revenue and understated its expenses over a three-year period.

However, the company has recovered remarkably since then, clocking outstanding gains over the past couple of years thanks to the emergence of a new catalyst in the form of artificial intelligence (AI). Its revenue in its fiscal 2024 more than doubled to $14.9 billion from $7.1 billion in the previous year. Non-GAAP earnings shot up to $22.09 per share, from $11.81 per share in fiscal 2023.

Addressing the delay in Supermicro’s annual filing, management clarified that “we don’t anticipate any material changes in our fourth quarter or fiscal year 2024 financial results.” It added that the company is looking forward to a “historic” 2025 with “a record number of orders, a strong and growing backlog of design wins and leading market positions across a number of areas.”

Supermicro says that the recent developments won’t affect its production capabilities, and it’s on track to meet the demand for its AI server solutions. It’s worth noting that Supermicro is expecting its fiscal 2025 revenue to land between $26 billion and $30 billion. That would be another year of remarkable growth from its $14.9 billion in fiscal 2024.

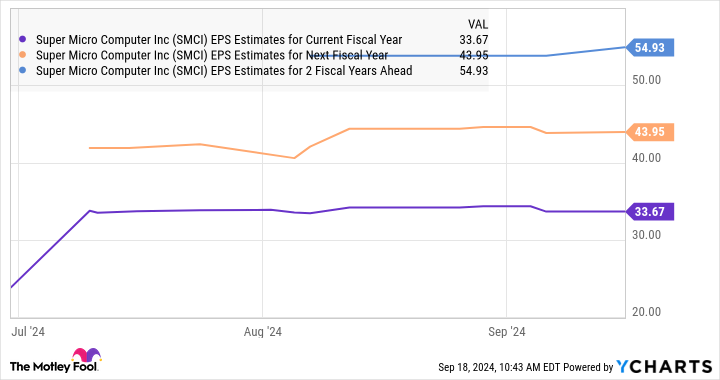

Though it is facing margin challenges due to the increased investments it’s making as it boosts capacity to meet the strong demand for its liquid-cooled server solutions, management is confident that it will return to its normal margin range before the fiscal year ends. Analysts’ consensus estimates also indicate that Supermicro’s earnings are on track to increase at an incredible pace in the current fiscal year, followed by healthy jumps in the next couple of years as well.

What should investors do?

The delay in Supermicro’s annual filing led JPMorgan to downgrade the stock from overweight to neutral and to slash its price target to $500 from $950. Even Barclays downgraded the stock to equal weight from overweight, citing the margin pressure that Supermicro faces as well as the filing delay. However, JPMorgan’s downgrade wasn’t a result of the Hindenburg report nor a reflection of its ability to become compliant, but because of the near-term uncertainty that surrounds the company and the lack of a compelling argument to buy the stock.

So, risk-averse investors would do well to wait for more clarity before buying this AI stock. However, those with higher risk appetites who are looking to add a fast-growing company to their portfolios can consider buying Supermicro now. It seems capable of sustaining its impressive growth in the long run thanks to the huge opportunities available to it in the AI server market.

Analysts expect Supermicro’s earnings to grow at an annualized rate of 62% over the next five years. If the company can get past its current troubles, it could turn out to be a solid investment considering the valuation at which it is trading right now.

Should you invest $1,000 in Super Micro Computer right now?

Before you buy stock in Super Micro Computer, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Super Micro Computer wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $710,860!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 16, 2024

JPMorgan Chase is an advertising partner of The Ascent, a Motley Fool company. Harsh Chauhan has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends JPMorgan Chase. The Motley Fool recommends Barclays Plc. The Motley Fool has a disclosure policy.

Is Super Micro Computer Stock a Buy Now? was originally published by The Motley Fool