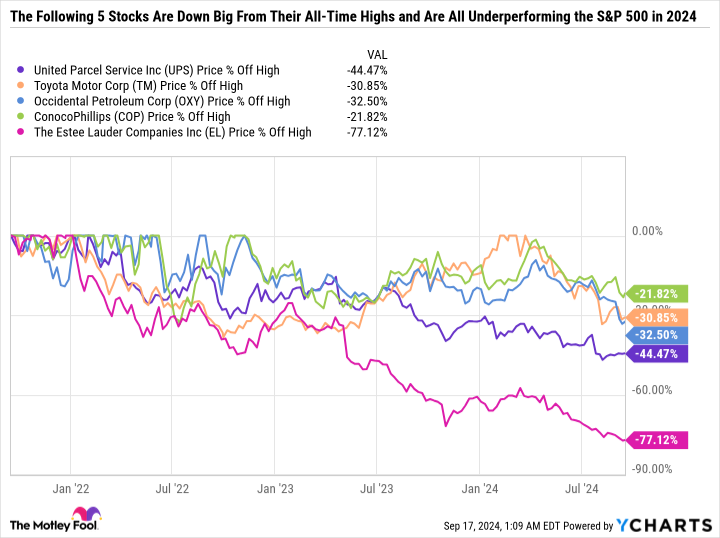

Occidental Petroleum (NYSE: OXY), ConocoPhillips (NYSE: COP), United Parcel Service (NYSE: UPS), Toyota Motor (NYSE: TM), and Estee Lauder (NYSE: EL) are all down big from their all-time highs.

Here’s why all have sold off and why each dividend stock is a great value now despite challenges.

Two beaten-down oil stocks to buy now

Exploration and production (E&P) company Occidental Petroleum, commonly known as Oxy, is the sixth-largest holding in Warren Buffett-led Berkshire Hathaway‘s public equity portfolio. Meanwhile, ConocoPhillips is, by far, the most valuable U.S.-based E&P by market cap. Despite these accolades, both companies have sold off during the past few months as West Texas Intermediate crude oil prices (the U.S. benchmark) have dipped below $70 per barrel.

Oxy and ConocoPhillips will sport lower profit margins when oil prices are low. But both companies can still be free cash flow (FCF) positive at prices much lower than today’s levels. Oxy’s portfolio has a breakeven level below $50 per barrel, while ConocoPhillips is working toward being FCF positive at just $35 per barrel.

Oxy completed its $12 billion acquisition of CrownRock in August, and ConocoPhillips announced plans to buy Marathon Oil for $22.5 billion in May. The more oil prices fall, the worse those deals will look, at least in the near term.

The sell-off is a buying opportunity for investors looking to scoop up shares of top E&Ps on sale. What’s more, Oxy has a dividend yield of 1.7% and ConocoPhillips has an ordinary dividend of $0.58 per share per quarter and a quarterly variable dividend based on the performance of the business. The variable dividend has been $0.20 per share for the past three quarters, so investors can estimate ConocoPhillips’ yield to be about 3%.

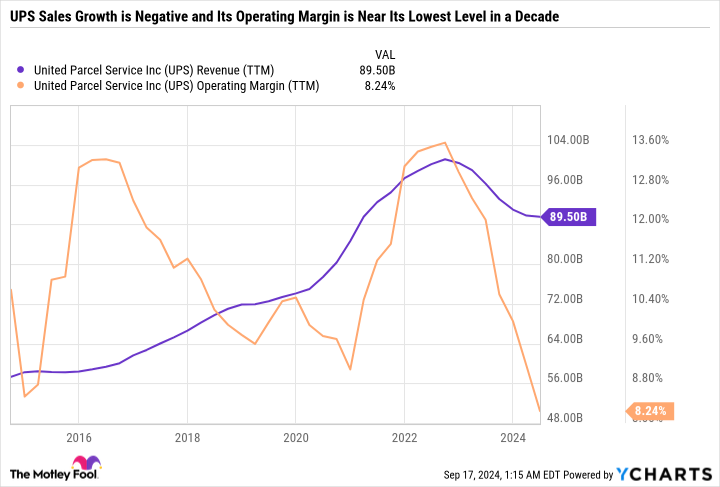

UPS can power a passive income portfolio

One look at the following chart, and it’s easy to see why UPS is down about 45% from its all-time high and is hovering near a four-year low.

UPS’s revenue has been falling for several years now, and margins have plummeted to 10-year lows. The main reason for the disappointing results is bloated costs due to overextended routes and higher operating expenses.

The good news is that UPS is returning to volume growth for U.S. package deliveries. It has assured investors that the dividend is safe, although it hinted that dividend raises are unlikely, given the company’s high dividend expense relative to its earnings.

Add it all up, and UPS and its 4.9% dividend yield stand out as a compelling turnaround play for investors who believe the company is set to return to growth.

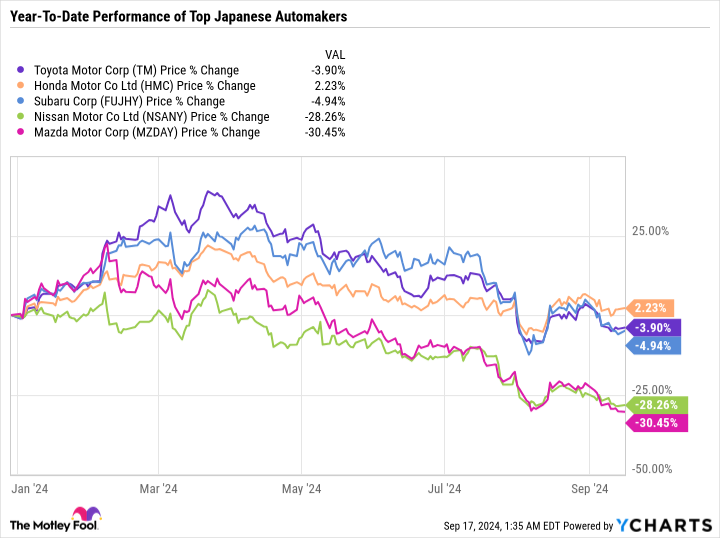

Toyota is making the right long-term investments

After a red-hot start to 2024 and a new all-time high for Toyota in March, Japanese automakers have sold off big time.

Car sales in Japan and China have been falling, which is dragging down Toyota’s results. So although trailing-12-month sales, operating margins, and diluted earnings per share are all at 10-year highs, the concern is that growth could slow, especially if interest rate cuts fail to spur U.S. new car sales.

Toyota is capitalizing on hybrid vehicles and debuting new low-carbon engine designs. It also pays a growing dividend. Now is a great time to scoop up shares of the world’s largest automaker by global sales volume.

Estee Lauder has fallen far enough

Estee Lauder stock has been pulverized lately. The beauty brand conglomerate has been on the wrong side of just about every trend during the past few years. It depends heavily on consumer discretionary spending, which has been challenging amid inflationary pressures and higher interest rates. It relies on in-person shopping in boutique outlets, airports, and malls. It’s also big in China, which hasn’t been going well.

Estee Lauder’s best quality is its portfolio of timeless brands, which don’t have as great of a risk of falling out of favor with consumers as trending brands. If the company can improve its marketing strategy and get costs under control, it could be a worthwhile turnaround candidate for passive income investors, especially considering it has already fallen to an eight-year low and yields 3%.

Get paid to wait with dividend income

Despite their differences, there’s a common thread among the five companies discussed: All are down for good reasons but have what it takes to recover and reward patient investors.

Oxy and ConocoPhillips have a nice cushion to maintain profitability even if oil prices fall. Still, investors should monitor how each company integrates its recent acquisitions and navigates a potentially volatile period.

UPS has to show it is charting a path toward higher margins and package delivery volume growth.

Toyota must navigate macroeconomic challenges while investing in innovations across low-carbon internal combustion engines, electric vehicles, and hydrogen-fueled cars.

Estee Lauder needs to revamp its sales strategy to maximize its brand lineup.

When looking at turnaround companies, the key is to know what to look for and have the patience to hold through periods of volatility. Stocks that pay dividends provide an incentive to be patient, making Oxy, ConocoPhillips, UPS, Toyota, and Estee Lauder much easier to buy and hold for at least five years.

Should you invest $1,000 in Occidental Petroleum right now?

Before you buy stock in Occidental Petroleum, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Occidental Petroleum wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $710,860!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 16, 2024

Daniel Foelber has positions in Estée Lauder Companies. The Motley Fool has positions in and recommends Berkshire Hathaway. The Motley Fool recommends Occidental Petroleum and United Parcel Service. The Motley Fool has a disclosure policy.

These 5 Dividend Stocks are Down 21% to 77%. Here’s Why They’re Worth Buying and Holding for at Least 5 Years. was originally published by The Motley Fool