Palantir (PLTR) is emerging as one of the leading AI companies globally, developing powerful platforms like Gotham, Foundry, Apollo, and AIP. Since the beginning of this year, the company has more than doubled its value through robust earnings results, demonstrating its progress in AI. However, while the street is divided on PLTR stock’s current appeal, despite the stretched multiples I remain bullish on the stock. This confidence is rooted within Palantir’s unique position in the AI revolution which is still in its early stages.

In this article, I will highlight and discuss recent developments regarding Palantir and explain why the current valuation premium may be justified.

Palantir’s Rally This Year

Palantir’s stock has seen triple-digit gains this year, soaring over 140% to reach all-time highs. Several key factors have come together in recent months to fuel this impressive rise.

First, the company’s commercial business has seen accelerated revenue growth. In its Q2 earnings report, released on August 5th, Palantir recorded a 55% year-over-year rise in business from its commercial sector, while government contracts increased by 24%. Another indication of strength comes from Palantir’s margin rates. Palantir achieved an operating margin of 16% in Q2, up 1,400 basis points year-over-year, continuing its trend of increasing profitability. Operating income rose significantly from $10.1 million in Q2 2023 to $105.3 million in Q2 2024.

Additionally, the potential mass adoption of Palantir’s Artificial Intelligence Platform (AIP) has emerged as a major catalyst. With AIP, Palantir has demonstrated unique technology that I view comparably to Nvidia’s (NVDA) microchips. In Q2 alone, the company closed 27 deals valued at $10 million or more.

A final reason for the price surge was Palantir’s inclusion in the S&P 500 index (SPX). The stock joined the index on September 23, solidifying investor confidence, particularly among institutional investors.

A Crucial Metric Reveals Much About Palantir

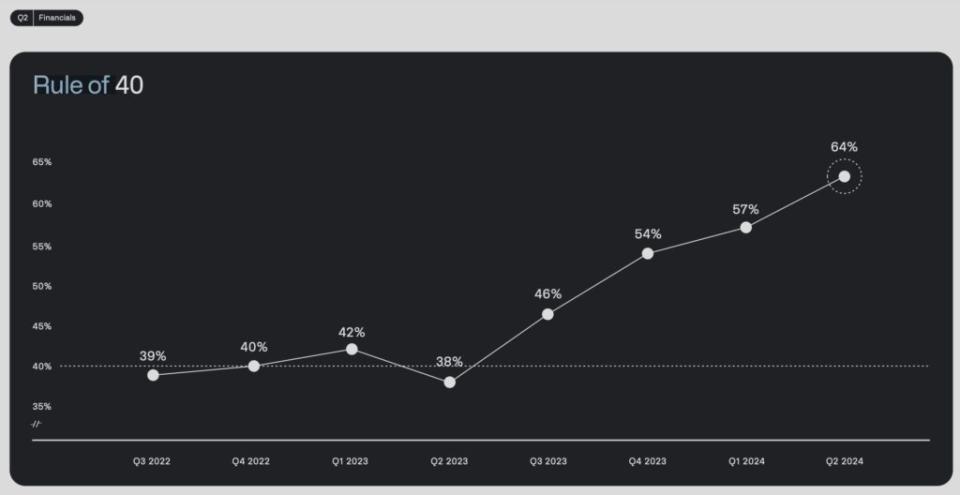

One of the main pillars of my optimism about Palantir lies in a metric the company reported for the first time in its most recent quarter: it’s status relative to the Rule of 40. The widely discussed Rule of 40 suggests that even if a SaaS (Software as a Service) company has low earnings today, it could still be a good investment if its revenue growth and profit margin percentages together total 40 or more.

During the Q2 earnings call, CEO Alex Karp highlighted that Palantir currently has a Rule of 40 score of 64, with revenue growth of 27% and adjusted operating margin of 37%. While it’s clear that Palantir exceeds the benchmark, how significant is a score of 64?

When we compare Palantir’s Rule of 40 score with other well-known SaaS companies, we can see that it stands out. For example, Adobe (ADBE) has a score of 51, Salesforce (CRM) has a score of 38, and CrowdStrike (CRWD) has a score of 37.

It’s worth noting that while these companies have scores below Palantir’s for various reasons, achieving a higher score becomes increasingly difficult. Companies with high Rule of 40 scores need to sustain either very high growth rates or very high operating margins. Most companies tend to excel in one area but not both. However, Palantir currently achieves good scores on both components.

Analysts predict that Palantir’s revenue growth will continue to exceed 20% annually until at least 2027, which would further support the company’s standing against the Rule of 40, especially if margins are at least stable.

PLTR Stock Valuation: The Key Point of Discussion

Arguably, one of the main items dividing Palantir’s bulls and bears is the company’s valuation. Undeniably, some traditional multiples are stretched. Palantir trades at a forward P/E ratio of about 120x, which is more than double the multiple at which Nvidia trades, for context. Even if we adjust this multiple for growth, using EPS growth estimates of 24.5% for the next three to five years, Palantir’s forward PEG ratio stands above 4.8, compared to Nvidia’s 1.28. This evidences the market’s very optimistic expectations for Palantir’s future.

Is this premium justified? I believe that paying a premium for a stock is justified only when the company offers something uniquely valuable or disruptive. In Palantir’s case, from my perspective there’s definitely something special. The company is a pure-play software provider, specializing in AI solutions for enterprises and government agencies. In CEO Alex Karp’s most recent letter to shareholders, he highlighted the “unrelenting wave of demand” from customers for production-ready AI systems, and Palantir is among the few companies that can meet that demand today.

Given these factors, I believe Palantir is uniquely positioned to capitalize on the trillion-dollar AI market and capture a significant share of the enterprise software sector, which is projected to reach about $790 billion by 2032.

Is PLTR Stock a Buy According to Wall Street Analysts?

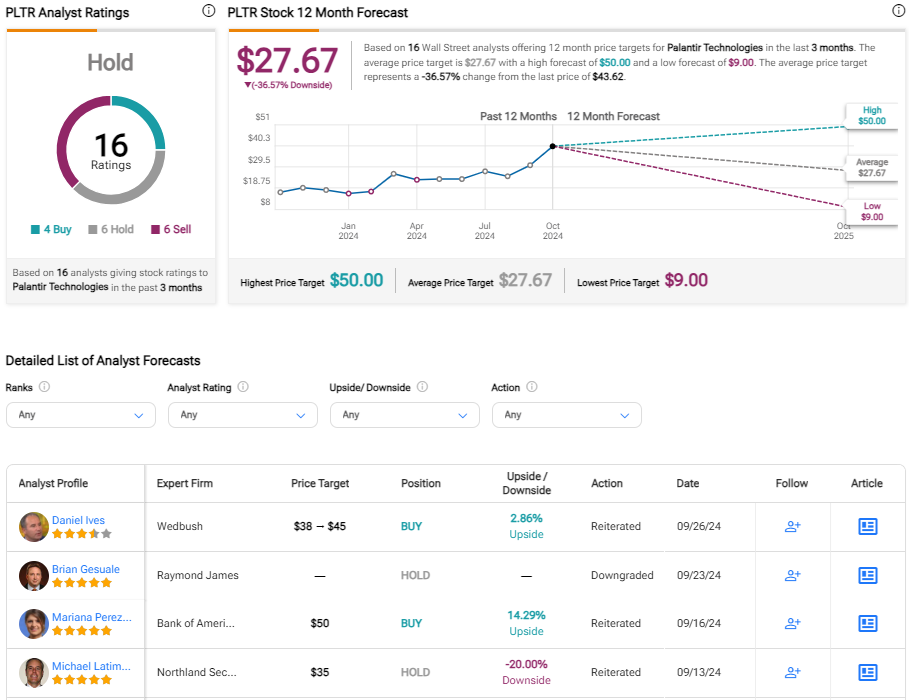

According to TipRanks, Wall Street analysts have a Hold consensus on PLTR stock. Among the 16 analysts that cover the stock, six recommend Hold, six suggest Sell, while only four advocate for a Buy. The average PLTR price target is $27.67, more than 35% below the current share price.

Conclusion

Although Palantir’s multiples may seem stretched for a new investment at the moment, the premium valuation appears justified as the company positions itself as a unique AI pure play. The company’s robust results in recent quarters confirm that demand for its platforms is high.

Additionally, key metrics like the Rule of 40 highlight Palantir’s distinct standing among software companies, which is likely to be sustained and even reinforced in the long term. As a disruptive technology firm, I believe PLTR stock’s premium valuation is warranted, even if traditional valuation metrics may not fully capture the company’s comprehensive value. I remain bullish on PLTR stock.