If you ask 10 botanists to define a fruit, you’ll probably get the same answer—but if you ask 10 different tax administrations, you might end up with 10 different ones.

The US Supreme Court in 1893 waded into those weeds in Nix v. Hedden, ruling that tomatoes, despite being botanically classified as fruit, were legally vegetables for tariff purposes.

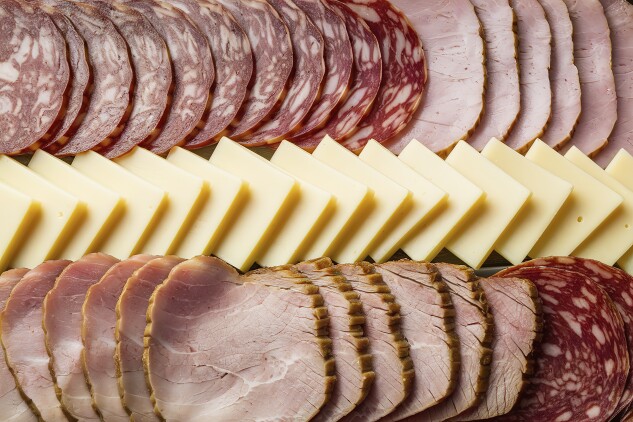

Fast forward to 2025, where a Buffalo, N.Y., deli owner lost his battle with a state tax tribunal, which ruled that the deli meat party platters he sold were taxable prepared foods. Arranging the items on a tray seemingly transforms the meat from tax-free grocery ingredients into a taxable culinary concoction.

Plenty of other tax and tariff definitions negate mainstream understandings. In Illinois, Starburst may be candy, but Kit Kats aren’t. The latter contains flour, and state law stipulates that candy is flour-free.

In the UK, plain biscuits, but not cakes, are exempt from one particular value-added tax. This helped McVitie’s, a manufacturer of Jaffa cakes, successfully argue for VAT-free cake status. The determination hinged in part on how the confections behave when stale.

All these definitional forays may affect small businesses disproportionately. Large corporations can have tax professionals at the ready to optimize classifications, but local deli owners have fewer resources.

If you’ve ever had a colleague call tax law a bunch of baloney, they may have had a point. If tax authorities want to prove them wrong, a little more predictability and consistency between jurisdictions would go a long way.

—Andrew Leahey

Welcome to the Week in Insights for Bloomberg Tax’s latest analysis and news commentary. This week, experts analyzed research and development tax credit laws, carbon capture trends, and more.

Insights

ATOZ Tax Advisers’ Petya Dimitrova explains new tax measures in Luxembourg that aim to attract corporate investment and talent.

Sycamore Growth Group’s Rick Kleban, Jenna Tugaoen, and James Bean ask Congress to change the law for research and development tax credits to allow small businesses to sell the credits faster and reinvest in more innovation.

Moss Adams’ Vernon Noronha and Felicita Moreno-Stevens say health-care and medical device companies need to consider Loper Bright‘s effects and global tax regulations when trying to adapt to international trade changes.

KPMG’s Monisha Santamaria and Natalie Tucker analyze proposed regulations for corporate alternative minimum tax, saying that applying them early to the 2024 tax year risks companies locking into unfavorable rules.

Norton Rose Fulbright’s Anastasia Slivker, Scott Burton, and Siyi Zhu examine carbon capture trends, noting that the green technology has a decade-long history of bipartisan support.

Fox Rothschild’s Brian Bernhardt examines a new IRS tactic for revealing income, saying it should give companies incentive to disclose foreign accounts and assets.

Columnist Corner

Washington State’s proposed severance tax on data collection would be less effective than a data retention tax in ensuring companies that profit from long-term data exploitation pay their fair share, Andrew Leahey says in his latest Technically Speaking column.

The Washington bill may simply promote consolidation, where large platforms specialize in collecting data, pay the tax, and distribute the data to other firms, Andrew writes, arguing that the proposal “leaves long-term privacy risks unaddressed and may encourage data hoarding.” Read More

How Are You Handling This Tax Season?

Bloomberg Tax Insights & Commentary is collecting a series of short essays (250-350 words) about how tax practitioners are coping with this year’s unusual—and somewhat chaotic—tax season. We want to hear:

- How you are managing client expectations with so many changes

- Go-to practices for dealing with the IRS during tax season

- How you’re dealing with stress and finding time to relax

The deadline for submissions is March 19, 2025. We’ll publish the best answers at the end of March.

Please send draft essays or any questions to rbaker@bloombergindustry.com with the words “Tax Season Essay” in the subject line of your email. Thank you!

News Roundup

Best Picture Nominees Filmed With Tax Credits Far From Hollywood

When the envelope for Best Picture is opened at the Oscars on Sunday, the winning film will almost certainly be one that received lucrative tax credits. But the increasingly competitive landscape of film tax credits has spurred criticism. Read More

EU Seeks Energy Tax Reform Under Industrial, Climate Plans

The EU will urge member states to zero out energy taxes to help expand the use of electricity and reduce fossil fuel usage, according to a pair of economic and environmental plans released Wednesday. Read More

Future of IRS Taxpayer Help Centers in Limbo After Filing Season

The IRS will keep all of its taxpayer assistance centers open through filing season, according to a person familiar with the situation. Read More

Norcross Corruption Case Tossed as NJ AG’s Case Unravels

A New Jersey trial court has dismissed corruption charges against Democratic Party powerbroker George Norcross and several co-defendants, including a former Camden mayor. Read More

Tax Management Memorandum

The Eleventh Circuit’s FBAR decision in Schwarzbaum should—and likely will—be upheld if and when the Supreme Court decides whether FBAR penalties are subject to the Eighth Amendment’s excessive fines clause, says Fisher, Tousey, Leas & Ball’s Scott St. Amand.

Updating and modernizing Section 197 and related rules on amortization must be prioritized for an improved tax system that better reflects how we live and do business today, says San José State University’s Annette Nellen.

Career Moves

Tyler Storhaug joined EisnerAmper as a partner in its tax practice in Minneapolis.

Melanie Bartlett joined Foley Hoag as a partner in its tax practice in Denver.

If you’re changing jobs or being promoted, send your submission to TaxMoves@bloombergindustry.com for consideration.