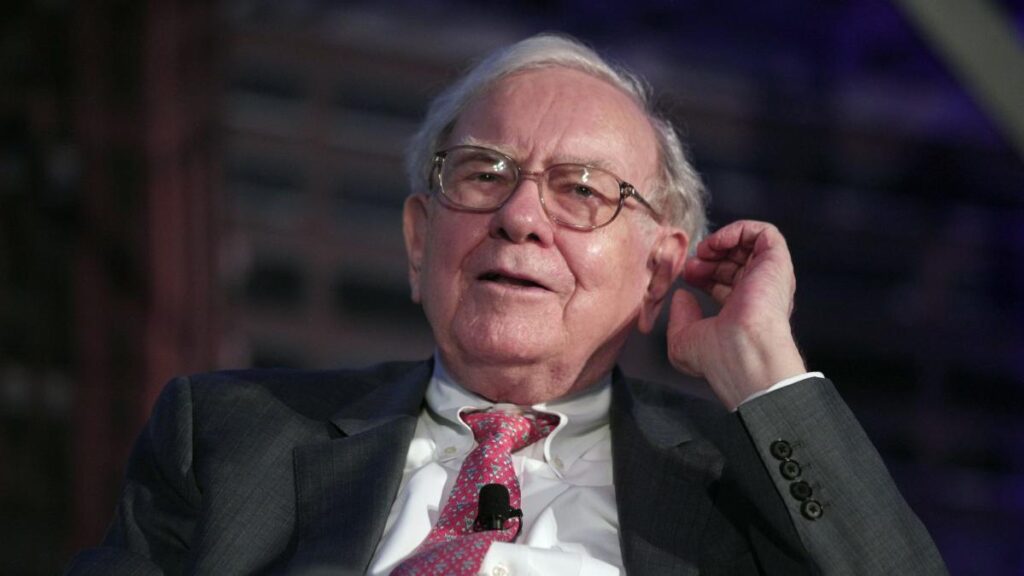

Berkshire Hathaway’s (BRK-B, BRK-A) cash holdings reach a record high as the firm cuts its stake in names like Apple (AAPL) and Bank of America (BAC). Smead Capital Management CEO Cole Smead joins Wealth! Host Brad Smith to discuss how investors can trade with a mindset like Berkshire CEO Warren Buffett.

Smead explains Buffett’s strategy of expanding his “circle of competence” to better invest outside of Wall Street’s biggest names. “Buffett used to talk a lot about the idea of your circle of competence. In other words, ‘What are the kinds of things that you can understand?’ Circle of competencies can grow over time, but they just can’t do it overnight.”

“We’re in this very narrow equity market, as many of us know, and you talk to a lot of these investors who are involved in this market, and they will tell you straight up that they’re very focused on certain industries or companies, things of that nature,” Smead adds. He notes that Berkshire’s largest purchase and sale this year have been Occidental Petroleum (OXY) and Apple, two names that, apart from economic growth, don’t overlap. “I point that out because I think one of the things that’s really lost on investors is Buffett is practicing a lifetime of learning, and what that allows you to do is over seasons of your career as an investor, you can grow your circle of competence by learning and learning and learning and watching other businesses.”

Watch the video above to learn more about how Smead recommends investing like Buffett.

To watch more expert insights and analysis on the latest market action, check out more Wealth here.

This post was written by Naomi Buchanan.