Nickel, a key component in electric vehicle (EV) batteries and stainless steel, is experiencing significant changes in supply dynamics and pricing. Recent activities by Nickel Industries and market reactions to global economic conditions paint a picture of both challenges and opportunities in the nickel sector.

Nickel Industries Strategic Moves in Indonesia

Nickel Industries, an Australian company, could become one of the largest nickel resource holders in the world with its strategic acquisitions in Indonesia.

In August 2024, the company signed agreements to purchase the Sampala project and secured a 51% stake in the Siduarsi project. These moves come amid a severe nickel ore shortage in Indonesia. This has led to a staggering 45% rise in local nickel prices since late 2023.

According to Justin Werner, Managing Director of Nickel Industries, this acquisition is crucial for mitigating the impact of ore shortages and the high prices associated with them.

The Sampala project boasts a significant resource of 2.3 million metric tons of contained nickel metal, along with 200,000 metric tons of cobalt. Werner expects this resource to expand dramatically, potentially reaching up to 10 million metric tons of nickel metal. Once that happens, it will be among the top five known nickel resources globally.

With plans to commence shipping ore by the end of 2025, Nickel Industries aims to ensure a self-sufficient ore supply for its operations in the Morowali Industrial Park.

In addition, the Siduarsi project has revealed an initial resource of 52 million dry metric tons at a promising nickel grade of 1.1%. This resource is anticipated to grow, and there are projections that the total contained nickel could double. Nickel Industries’ strong position in Indonesia positions it as a key player in the global nickel market.

Global Price Shifts and Market Impact

While Nickel Industries is making headlines with its acquisitions, broader market trends are affecting nickel prices globally.

- The London Metal Exchange (LME) recently reported that nickel prices fell to $15,873 per metric ton by the end of October 2024. This decline followed a brief surge to a four-month high of $18,153 per ton earlier in the month.

The drop was largely attributed to a lack of investor enthusiasm following China’s recent stimulus measures, which did not meet expectations for more aggressive economic support.

China is the world’s largest consumer of industrial metals, and its economic health is vital for nickel prices. After the Chinese central bank announced its stimulus package on September 24, 2024, investor confidence briefly increased, leading to higher nickel prices.

However, as details of the package emerged and manufacturing activity in China remained weak, investor sentiment shifted, causing prices to retreat.

Data from S&P Global Commodity Insights maps in detail major market events impacting LME 3M nickel prices shown below.

Adding to this volatility, stocks of Russia-origin nickel in LME warehouses increased significantly, rising 19.6% month over month, per S&P Global analysis.

This surge in inventory occurs despite an LME ban on new deliveries from Russia in response to geopolitical tensions. As a result, a mix of increased nickel stocks and reduced investor confidence has put downward pressure on LME nickel prices.

Indonesia’s Production Strategy in Focus

Indonesia remains a pivotal player in the global nickel landscape. The country’s energy and mineral resources minister indicated that the government plans to regulate nickel ore production to maintain a balance between supply and demand.

Such strategy is particularly important given the challenges posed by a new domestic mining approval system that has led some producers to import nickel ore from the Philippines, the second-largest nickel producer.

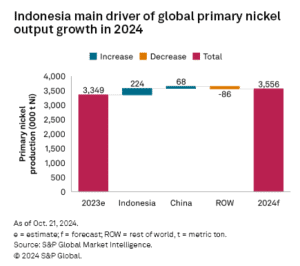

Interestingly, despite the tight supply situation, Indonesia’s primary nickel output increased by 14.5% year-over-year during the first eight months of 2024. The largest nickel producer is also trying to shift away from China-based ownership to qualify for the U.S. Inflation Reduction Act of 2022.

This trend highlights the country’s potential to drive global nickel production growth. As Indonesia continues to manage its production levels carefully, it can maintain its status as a leading supplier in the nickel market.

How Do Future Nickel Prices Look Like?

Looking ahead, S&P Global analysts have revised their price forecasts for nickel. Following the October price fluctuations, the forecast for the LME nickel price in the December quarter has been upgraded to $16,583 per ton. This reflects a decline compared to the previous year.

Nevertheless, ongoing discussions in China about issuing significant amounts of debt to stimulate growth could improve investor sentiment and support nickel prices in the near future.

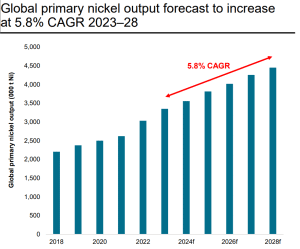

Projections show a surplus in the global primary nickel output over the next four years, growing annually at almost 6%. Yet, Indonesia’s evolving mining policies and production strategies introduce uncertainties that could affect this outlook.

The recent developments in both Nickel Industries and the broader nickel market underscore the dynamic nature of this essential metal industry. The future of nickel will depend not only on local production strategies in Indonesia but also on global economic conditions and investor confidence.