A new report from Viridios AI, a provider of carbon credit pricing and data, offers valuable insights into the current landscape of the voluntary carbon market (VCM). It shows the VCM experienced relatively low trading activity, with notable fluctuations in the prices of specific projects.

However, year-to-date retirements in 2024 reveal strong demand for carbon credits and they’ve exceeded those in the same period in 2023. We highlight the key insights below that may have a huge impact on the VCM’s future.

Demand Outpaces Supply With Record Carbon Credit Retirements

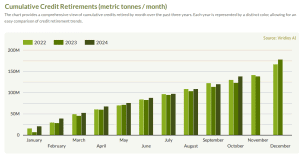

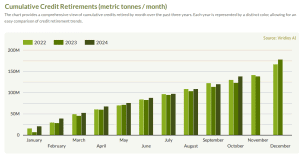

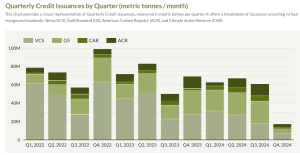

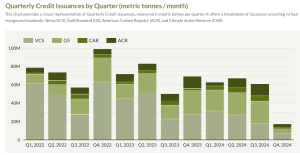

Viridios AI used data from the four major carbon registries in generating the graphs:

- Verra,

- Gold Standard,

- American Carbon Registry, and

- Climate Action Reserve.

As of now, 2024 year-to-date retirements have surpassed those in the same period in 2023, with a remarkable 147 million credits retired from the largest registries.

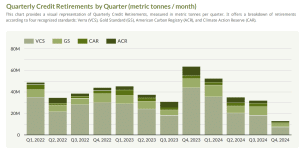

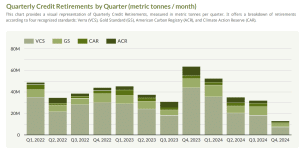

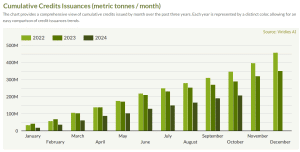

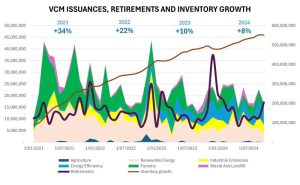

As seen in the first chart above, monthly cumulative carbon credit retirements keep on growing, with the recent month surpassing both the 2022 and 2023 results. Similarly, quarterly credit retirements in 2024 (second chart) exceeded those in the same period last year.

This trend highlights a growing commitment among companies and organizations to offset their carbon footprints. It also reflects a robust demand for carbon credits in the face of increasing regulatory pressures and climate goals.

In contrast, the market shows signs of shifting from oversupply toward a tightening of inventory with a slowing growth rate.

The graph reveals that monthly cumulative credit issuances, or credit supply, in 2024 are still growing. However, the amount (in metric tonnes) of issuances this year has significantly dropped compared to last year and even so since 2022.

The quarterly carbon credit supply paints a different picture. While Quarters 1 and 2 have seen lower issuances in 2024 versus 2023, Q3 experienced much higher supply, with over 10 million metric tonnes compared to the same period last year.

In a separate analysis, overall credit inventory has risen, but the rate of increase has slowed significantly—from 34% in 2021 to 8% in 2024 so far.

These changes point to a narrowing supply-demand market gap, especially as we approach the typical Q4 surge in voluntary carbon credit retirements.

Credit Supply Challenges Loom

Supply issues are prominent, with REDD+ credit (projects including efforts to avoid deforestation and degradation) volumes declining. REDD+ credit volumes could face reductions exceeding 60% due to new methodologies like VM0048, making some projects financially unfeasible.

Viridios AI data further suggests that the VCM experienced relatively low trading activity, with notable fluctuations in the prices of certain carbon projects.

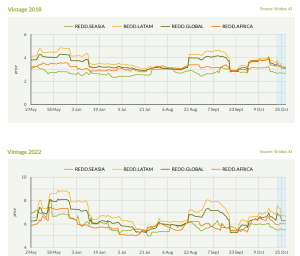

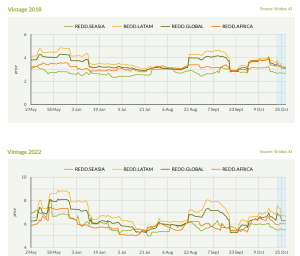

The report shows that REDD+ credit prices in all regions, both for vintages 2018 and 2022, have been falling. The biggest retiree of REDD+ carbon credits for the last 30 days is the French energy major Engie SA. The company retired over 907 thousand metric tonnes of these credits from the Congo REDD+ project.

Alternative sources, such as cookstove projects, may bridge part of the supply gap but also at reduced volumes. These projects lower carbon emissions through efficient cookstoves that release fewer pollutants and use less biomass.

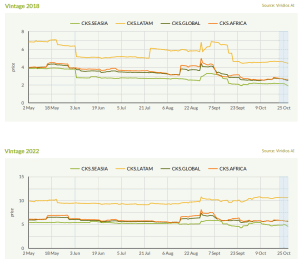

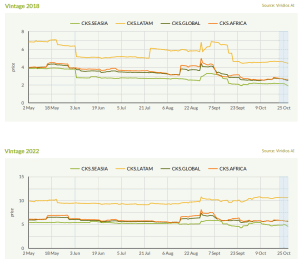

Viridios AI report reveals that prices for cookstove carbon credits are increasing in Latin America and Southeast Asia regions. On the other hand, prices in Africa for these projects have been dropping in all vintages (2018-2022).

Carbon Price Tension Ahead

The Viridios AI report on the VCM presents a complex picture of the shifting supply and demand landscape for carbon credits, highlighting trends that are likely to impact future pricing.

The key takeaway is a narrowing supply-demand gap as credit issuances slow, while retirements—reflecting demand—continue to surge. This dynamic has implications for the price stability of specific carbon credits, like those tied to REDD+ and cookstove projects.

The voluntary carbon market is increasingly used by companies to offset their emissions. However, with current low carbon credit prices discouraging new investments, the market’s capacity to meet rising demand may be limited. And with a continued strong retirement rate, this could drive prices up as supply struggles to keep pace, especially for high-quality carbon credits.

The upcoming discussions and decisions at COP29 will likely play a pivotal role in shaping the future of carbon markets, especially concerning the integration of REDD+ initiatives. Stakeholders will be watching closely as they navigate the evolving carbon market.