The U.S. recently expanded a manufacturing tax credit to cover extraction and material costs, benefiting metal refiners but excluding pure mining companies. This update was announced in final regulations by the Treasury Department and Internal Revenue Service (IRS).

The credit, known as the Section 45X Advanced Manufacturing Production Credit, is part of the Inflation Reduction Act. It aims to support the domestic production of clean energy products, including renewable components, battery materials, and 50 essential minerals critical to the energy transition.

What is Section 45X Tax Credit and How Does It Work?

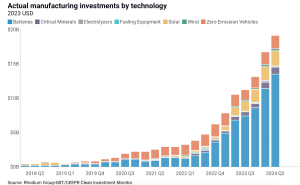

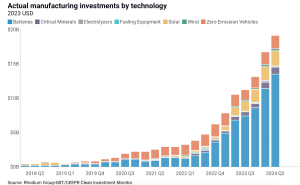

Since its inception, the Advanced Manufacturing Production Credit has already spurred private-sector investments. It has driven $126 billion in investment announcements, including $6 billion targeted for critical minerals, according to the Treasury Department.

The 45X tax credit offers financial benefits for producing solar and wind components, battery parts, and refining or recycling critical minerals. Manufacturers earn credits based on unit production, electrical capacity, or production costs. Importantly, these credits are transferable, allowing companies to maximize their benefits.

- Starting in 2023, the credit is available until 2032, with most goods phasing down to 75% of the credit value in 2030, 50% in 2031, and 25% in 2032, though critical minerals are exempt from this reduction.

This stable, decade-long credit has encouraged long-term investments, with manufacturing investments rising 305%. According to Clean Investment Monitor data, they reached $89 billion in 2023-2024 from $22 billion in 2020-2022.

The 45X tax credit works by providing a specific tax credit value for each eligible component under IRS guidelines. To qualify, manufacturers must ensure their products meet the requirements outlined in the 45X regulation. Additionally, for the tax credit to be claimed, the component must be sold to an unrelated third party.

The Expanded Scope of 45X Tax Credit

Initially, the tax credit did not cover extraction or material costs. However, after seeking industry input, the Biden administration decided to broaden the credit’s application.

With this change, the tax credit now includes costs related to materials and extraction for qualifying minerals and electrode materials, provided they meet specific conditions. The Treasury Department stated that this decision is intended to encourage investment in U.S. critical mineral extraction and processing. The broader goal is to enhance U.S. energy security and strengthen clean energy supply chains.

The 10% production cost tax credit applies to highly refined metals. This move is part of a U.S. strategy to build supply chains that support energy transition sectors, like electric vehicles and green energy. Eligible minerals include essential battery metals such as nickel, lithium, and graphite, along with rare earth elements like neodymium.

Treasury Secretary Janet Yellen commented that the final regulations will help companies investing in the U.S. clean energy economy. Additionally, the Treasury confirmed that the tax credit extends to components made with foreign-sourced materials. This aspect of the rule is intended to ensure flexibility for U.S. manufacturers, particularly in sectors where certain raw materials are difficult to source domestically.

A Boost for Critical Mineral Refiners, But Pure Miners Miss Out

Nickel production, along with other battery metals, would greatly benefit from the tax credits. This comes timely after primary nickel production, which includes ferronickel for steelmaking and intermediates for EV batteries, saw significant growth.

S&P Global Commodity Insights reported that the top 5 publicly listed nickel producers reached a combined output of 158,937 metric tons. It represents a substantial 35.6% increase from Q2 2023. This boost is largely attributed to the rising demand for refined nickel products, especially for use in EV batteries.

The recent nickel price slump has hit profitability industry-wide, yet companies are hesitant to cut production. They fear that doing so may lead to a loss in market share.

With the expanded 45X credits, primary nickel producers will have more reasons to accelerate their production.

However, the final rules of the expanded credit have not gone far enough in the eyes of many in the mining sector. Specifically, pure-play mining companies, which focus solely on extraction without refining, remain ineligible for the credit.

Stimulus for Clean Energy Goals, Yet Gap Remains

The National Mining Association (NMA) has expressed disappointment, arguing that the regulations do not align with the original intent of Congress to strengthen the entire U.S. mineral supply chain.

The organization had previously requested that the tax credit apply to all domestic mining companies, regardless of whether they also refine materials. However, the new rules limit credit only to producers who both mine and refine materials. This decision leaves out U.S.-based miners who do not have refining capabilities, and the credit still applies to imported materials.

Rich Nolan, president and CEO of the NMA, criticized this limitation. He stated that the rule does not adequately support efforts to address strategic vulnerabilities in U.S. mineral supplies, especially as it allows credit for foreign-sourced materials.

The NMA argues that this oversight hinders U.S. competitiveness, particularly against countries like China and Russia that dominate global mineral supply chains with cheaper materials.

As the clean energy market grows, balancing interests across the sector will remain challenging. Ensuring that a diverse range of domestic mining companies can benefit from the tax credit will be essential to achieving a resilient, self-sustaining U.S. critical mineral supply chain.