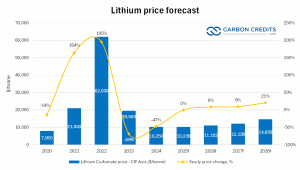

From the latest news from CarbonCredits, you can see that the lithium market has entered a period of price decline. This is mainly because of weaker demand conditions and an oversupply of lithium carbonate in key regions. However, this trend doesn’t favor the top lithium miners and producers across the globe. Recently Albemarle and Pilbara have taken some drastic steps to counter the lithium market lows.

Let’s see how they are navigating the challenges…

Albemarle’s Strategy for Surviving the Lithium Market Slump

As a consequence of dropping lithium prices, Albemarle Corporation is set to reduce its global workforce by between 6% and 7%, which will save around $300 million to $400 million annually as reported by S&P Global Commodity Insights.

Despite being the world’s largest lithium producer, the company reported a net loss of $1.07 billion for the third quarter. The company released its earnings report on November 6.

Kent Masters, Albemarle’s president and CEO expressed himself by saying,

“Right now we’re focused on making sure that we put the cost structure in place to compete through the bottom of the cycle. We’re trying to create the flexibility to pivot up if the market returns.”

The New Approach

The earning report revealed how the company is planning to streamline its organization by adopting a more integrated and functional model. In purview, it will reduce its 2025 capital expenditures by about 50% compared to 2024 to bring spending down to between $800 million and $900 million.

The company noted that this quarter’s results sharply contrast with the $302 million net income earned in the same period last year.

CEO Kent Masters emphasized that China has scaled back high-cost lepidolite production, while Australian miners have reduced output and laid off employees in response to market conditions. Still, these trimming measures are insufficient to stabilize lithium prices.

According to him, the surprising factor is that “African supply has filled Chinese cuts.”

On the demand side, CFO Neal Sheorey highlighted a 36% increase in demand for lithium in grid storage this year, driven by U.S. and Chinese projects, along with a 23% rise in global electric vehicle registrations.

Albemarle estimates that around 25% of the lithium industry is currently operating at a loss. The reason is again the oversupplied market. However, the top lithium producer wants to stay competitive over the long term. This is why they have conducted a thorough review of their costs and operating structure.

Broadly speaking, they revealed their potential future actions to address ongoing market challenges. Masters said that, while rising demand could help restore balance further production cuts will be essential to stabilize prices effectively. In response to the lingering low lithium prices, the company plans to adopt a conservative growth strategy to ensure long-term reliance.

Notably, In July, Albemarle halted expansion plans at its Kemerton lithium hydroxide refinery in Australia to manage costs more effectively.

Li-FT Power Ltd. (TSXV: LIFT) recently announced its first-ever National Instrument 43-101 (NI 43-101) compliant mineral resource estimate (MRE) for the Yellowknife Lithium Project (YLP), located in the Northwest Territories, Canada.

An Initial Mineral Resource of 50.4 Million Tonnes at Yellowknife.

This maiden estimate is a major milestone for the company and marks a significant step forward in the project’s development. Li-FT Power’s upcoming mineral resource is expected to further solidify Yellowknife as one of North America’s largest hardrock lithium resources.

Click to learn more about lithium and Li-FT Power Ltd. >>

________________________________________________________________________

Pilbara’s Strategic Move to Overcome Lithium Price Dip

On October 30, Pilbara Minerals announced its decision to pause construction of their Mid-Stream Demonstration Plant Pilgangoora lithium mine in Western Australia citing weak lithium prices as the main reason. The project is a JV with environmental technology company Calix Ltd formed in November 2022.

The smaller Ngungaju plant will be placed on temporary care and maintenance from December 1 which will allow the company to manage current price pressures more efficiently.

Pilbara Minerals highlighted that spodumene concentrate prices, ranging from US$750 to $800 per ton, remain below the sustainable industry benchmark of US$1,400 per ton.

- In the September quarter, the company sold lithium at an average of US$682 per ton, a decrease from US$840 per tonne in the previous quarter.

The demonstration plant at Pilgangoora that would produce lithium salts using Calix’s advanced calcination technology was 60% completed by the end of September this year. Pilbara anticipates these measures will contribute about A$200 million in cash flow improvements for fiscal 2025.

Cutting Capital Expenditure

- MINING.com reported: Pilbara Minerals also revised its production guidance for fiscal 2025 to a range of 700,000 to 740,000 dry metric tonnes (dmt). It’s down from an earlier target of 800,000 to 840,000 dmt.

Meanwhile, it has cut its capital expenditure forecast to between A$565 million and A$610 million, down from a previous estimate of A$615 million to A$685 million.

Managing Director and CEO Dale Henderson,

“Given current lithium price environment, this pause enables the joint venture to time expenditure with improved market conditions. We remain fully supportive of the midstream strategy and our joint venture, recognising the Project’s potential to transform the lithium supply chain through lower emissions and value-added processing. Our commitment to our joint venture with Calix remains. We will assess with Calix resuming the Project as market conditions improve or further government support is received.”

Lithium Glut Lingers, Even as Demand Surges

According to S&P Global Commodity Insights, the lithium market is expected to face a supply surplus until at least 2027. However, this excess supply will maintain low lithium prices until demand rises to balance out the excess.

Data Source: S&P Global

Analyzing the market condition further, the lithium scenario is quite vivid. This rapidly growing demand has attracted new lithium players, but major producers are yet to make significant production cuts.

Explore here to learn everything about what’s happening with lithium now: The Lithium Paradox: Price Plummet, Supply Surge, and Demand Dip – What’s Happening Now?