Most industrial greenhouse gas (GHG) emissions come from energy use. By improving energy efficiency, the world can cut energy consumption, lower emissions, and save on costs. It’s a smart and cost-effective first step toward decarbonization and businesses are continuing to pour funds into energy efficiency initiatives and technologies worldwide as the International Energy Agency (IEA) reported.

The IEA’s Energy Efficiency 2024 highlights key trends in energy intensity, demand, prices, and policies. It also offers insights into system-wide themes including investment, which this article will delve into in detail.

Driving Change: What Leads the Energy Revolution?

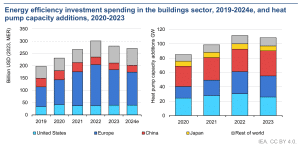

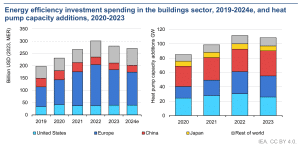

The report shows that energy efficiency investments could remain resilient in 2024, with total spending projected to reach around $660 billion. This level matches the record set in 2022 and highlights the steady commitment to sustainable energy use. These investments span sectors like transport, buildings, and industry, driven by the need to reduce emissions and enhance energy efficiency amid fluctuating economic conditions.

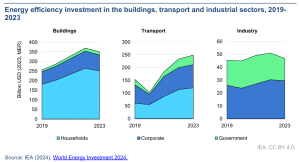

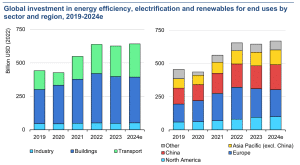

Since 2019, global energy efficiency investments have surged by 45%, fueled by the energy crisis and significant government spending post-Covid-19. The transport sector has seen the highest growth, with a 77% rise, followed by buildings at 34% and industry at 13%.

However, from 2022 to 2024, the trend shifted. Investments in buildings dropped by 7%, while transport saw a 14% rise, and industry remained steady.

A key driver for the trend is the push for efficient electrification, especially in the electric vehicle (EV) sector across China, Europe, and North America. EV sales, particularly in emerging markets, have supported this trend.

However, as energy prices stabilize and government stimulus wanes, overall global investment has plateaued. Rising inflation and interest rates also pose challenges for financing efficiency upgrades.

Emerging Markets Take the Spotlight in Efficiency Investments

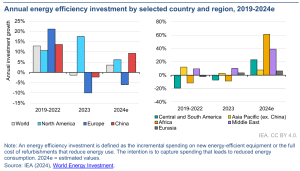

The growth of efficiency-related investments in 2024 is uneven across regions. Emerging markets and developing economies (EMDEs) are expected to lead.

Africa is projected to see a 60% rise, the Middle East 40%, and Central and South America over 20%. China will also witness nearly 10% growth.

Conversely, advanced economies are stabilizing after years of crisis-driven spending. Europe is set for a slight decline, while North America will see a modest 5% increase.

Despite slower growth in these regions, they still account for the bulk of global energy efficiency investments—95% of total spending occurs in Europe, Asia Pacific, and North America, regions responsible for about 75% of global energy demand.

Transport Electrification: A Surge in EV Sales

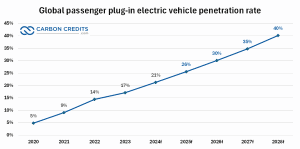

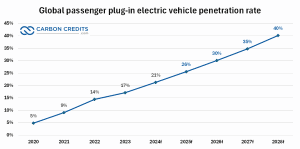

Globally, the electrification of transport has gained momentum. By 2024, around one in five new cars sold will be electric.

EV sales reached 14 million in 2023, making up 18% of total car sales, and this figure is expected to grow to 17 million in 2024. The bulk of these sales occurred in China, Europe, and North America, which accounted for 95% of global EV sales.

In EMDEs, the focus remains on two- and three-wheelers. These vehicles dominate markets in regions like Southeast Asia and Latin America. China leads in two-wheeler sales, though global sales in this category dropped 18% in 2023 due to supply chain disruptions.

India, however, saw a 40% increase in electric two-wheeler sales and continued growth in three-wheelers, spurred by government initiatives like the Electric Mobility Promotion Scheme.

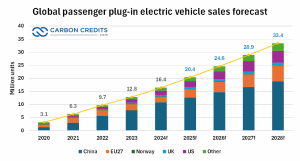

According to S&P Global data represented by the chart below, global passenger plug-in EV sales could reach over 33 million units by 2028. That’s almost a 104% increase in EV units sold. China is set to take the biggest growth in sales.

The number of people projected to use EVs for the same period (penetration rate) will also double by 2028 compared to 2024.

Source: S&P Global

Building Smarter: A Post-Crisis Slowdown

Investment in energy-efficient buildings boomed during the energy crisis, driven by technologies like heat pumps. In 2022, heat pump sales peaked, particularly in Europe, where they are central to long-term climate goals.

However, this momentum slowed in 2023 due to high electricity prices and reduced government support. For instance, Italy’s Superbonus program, which heavily subsidized energy-saving renovations, was phased out in 2024. This program alone accounted for more than half of Italy’s building sector investments in 2023.

Meanwhile, heat pump deployment in China has seen modest growth. These trends highlight the critical role of government policies in sustaining investment in building efficiency.

ESCOs and the Power Players Behind the Efficiency Boom

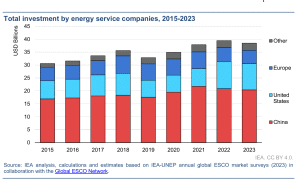

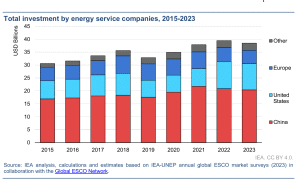

The energy service company (ESCO) market experienced a slight decline in 2023, dropping by 2.2%. Despite this, the market size remains robust at over $35 billion, supported by strong policies in regions like the U.S.

Federal programs, such as the Federal Energy Management Program, have bolstered ESCO activities, which grew by 54% between 2021 and 2023 in the U.S.

China leads the global ESCO market, with investments exceeding $20 billion in 2023, accounting for half the global total. The majority of ESCO investments target the buildings sector, followed by industrial applications and energy storage.

Among the major players in the ESCO market, some of the interesting companies making waves in the sector include:

- Johnson Controls is a global leader in smart building solutions, offering advanced technologies and services to enhance building performance and sustainability. In energy efficiency, Johnson Controls has made significant progress by implementing high-capacity heat pumps and optimizing energy use in various industries. They have contributed to over $6 billion in customer projects worldwide, driving sustainability and reducing carbon footprints.

- Ameresco is a leading cleantech integrator that specializes in energy efficiency, renewable energy, and infrastructure modernization. In 2023, its renewable energy projects and assets helped avoid around 16 million metric tons of CO₂ emissions, contributing to over 110 million metric tons of cumulative carbon reductions since 2010. Ameresco has received numerous awards for its sustainability efforts and continues to drive innovation in clean energy.

- Trane Technologies, through its flagship brand Trane, provides innovative HVAC solutions designed for energy efficiency and sustainability. The company delivers services such as Energy Savings Performance Contracting (ESPC) to optimize energy consumption and reduce operational costs for buildings. Trane emphasizes sustainability, helping clients meet carbon reduction goals through electrification, energy monitoring, and renewable energy integration.

- NORESCO is specializing in energy and infrastructure solutions for government, institutional, and commercial clients. The company has a strong track record in improving energy efficiency, managing over $2.75 billion in federal energy projects. It helps clients achieve sustainability goals through advanced technologies like microgrids, battery storage, and renewable energy systems.

Scaling Up: What’s Needed for 2030?

To meet net-zero targets, energy efficiency investments must triple by 2030, reaching $1.9 trillion annually, per the report. The IEA’s NZE Scenario underscores the importance of a comprehensive strategy tailored to each country’s needs.

In emerging economies, efforts focus on improving building performance and electrifying transport. In sub-Saharan Africa, the transition to clean cooking fuels is a top priority. Advanced economies, meanwhile, focus on retrofitting older infrastructure, deploying heat pumps, and scaling up EV infrastructure.

Ultimately, energy efficiency investment is vital for meeting global climate goals and expanding investment to underrepresented regions will be key to accelerating progress.