Deputy Prime Minister and Finance Minister Chrystia Freeland announced that the Canada Carbon Rebate for small businesses will not be taxed.

Freeland clarified this in a statement on X, following concerns from the Canadian Federation of Independent Business (CFIB) that the rebate would be considered a taxable benefit.

Freeland’s post reaffirmed the government’s commitment to providing financial relief for small businesses without adding tax burdens.

The CFIB posted on X that the government will tax the long-awaited $2.5 billion carbon tax rebate for small businesses when it’s issued in December.

CFIB President Dan Kelly criticized the move, comparing it to taxing a tax refund. He stated that this undermines claims of the carbon tax being revenue-neutral, as the government will collect significant corporate tax revenue from the rebate.

The Canada Revenue Agency initially assured CFIB that the rebate would be tax-free, similar to the Canada Carbon Rebate for individuals.

However, the Department of Finance later declared the small business rebate as taxable, considering it “government assistance.” Kelly argued that calling the rebate government assistance is absurd since it merely returns a portion of the taxes small businesses have paid.

CFIB’s Campaign Pays Off

The carbon tax system has long been criticized for its unfairness to small businesses. After initially promising 10% of total carbon tax revenue as rebates in 2019, the government delayed issuing the funds for five years.

The rebate only materialized after persistent lobbying by CFIB and widespread support from business owners, opposition leaders, and provincial premiers.

Adding to the frustration, the carbon tax will increase again on April 1, 2025. Meanwhile, future rebates for small businesses will be slashed from 9% to 5% of total revenue.

In response, CFIB has sent an open letter to Finance Minister Chrystia Freeland, urging the government to reverse course. Kelly noted that:

“It’s clear why 83% of small business owners now oppose the carbon tax. Delaying, taxing, and reducing promised rebates make it evident that the carbon tax should be scrapped entirely.”

Business owners can estimate their rebates and sign CFIB’s petition to abolish the tax using the CFIB’s online calculator.

The Carbon Tax Controversy Continues

The Canada Carbon Rebate (CCR), formerly the Climate Action Incentive Payment (CAIP), is a tax-free payment that helps individuals and families offset the federal carbon price. It includes a base amount, with an extra supplement for those in small or rural communities.

The rebate amount varies by province and is calculated annually based on projected carbon pricing revenue in each province.

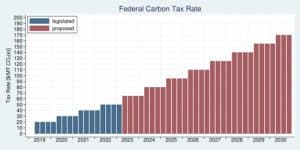

The federal carbon price currently increases gasoline costs by about 17.6 cents per liter, but quarterly rebates help Canadians manage these expenses. The chart below outlines the government’s planned annual carbon price hikes, implemented every April 1st.

Canada’s carbon price is currently set at C$65 per tonne and will rise to C$80 per tonne on April 1. After that, it will increase by C$15 annually, reaching C$170 per tonne by 2030. These incremental hikes aim to reduce emissions while generating revenue to support climate initiatives.