Sustainable and traditional large-cap portfolios are frequently similar, holding many of the same companies. But looking at the stocks owned uniquely by sustainable funds—those that use environmental, social and governance criteria—can offer investment ideas for sustainable investors.

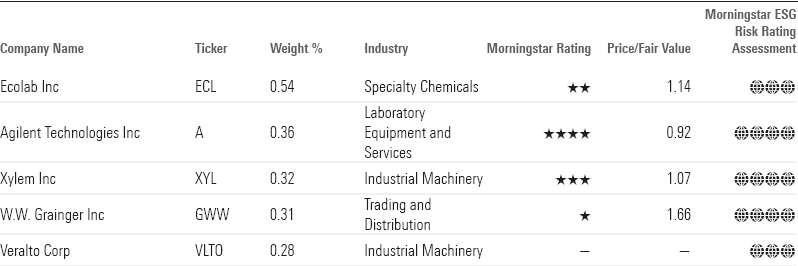

While there are a lot of similarities, what stocks are unique to sustainable funds? We looked at a breadth of large-cap funds, which primarily invest in companies with substantial market capitalizations, and found stocks that are common to both sustainable and traditional funds and those exclusively owned by ESG funds. The top five unique stocks are Ecolab ECL, Agilent Technologies A, Xylem XYL, W.W. Granger GWW and Veralto VLTO.

Our Methodology

Big-picture goals are the same for both conventional and sustainable funds, whose managers aim to invest in stocks that perform well against their benchmark and mitigate risk. ESG funds add a sustainable lens, focusing on limiting ESG risk, seeking ESG opportunities, or targeting specific themes.

We compiled the holdings of the oldest share classes of all US sustainable large-cap funds. We put the top 200 stocks that are commonly owned in a theoretical portfolio. We calculated what the average weight of each security would be if this portfolio held all 200 stocks. We did the same with traditional funds, defining the universe as the oldest share class of large-cap funds, excluding sustainable funds.

By doing so, we can find stocks overweight and unique to sustainable funds in the large-cap universe. In this case, “overweight” stocks are those that hold a greater weighting in sustainable funds compared with traditional. Securities that are held in sustainable funds, but not conventional ones, are considered “unique.”

Stocks Unique to ESG Funds

We found five stocks owned exclusively by large-cap sustainable funds in the industrials, materials, and healthcare sectors. We describe them below, with insight from Morningstar analysts and Sustainalytics.

Ecolab

Morningstar Rating: 2 Stars

Morningstar ESG Risk Rating Assessment: 3 Globes

Price/Fair Value: 1.14

Total Return Year to Date (Month-End): 24.75

“As the global leader in the cleaning and sanitation industry, Ecolab provides products that help its hospitality, foodservice, and life-sciences customers do laundry, wash dishes, maintain clean manufacturing environments, and ensure regulatory compliance. With unmatched scale and a solid razor-and-blade business model, Ecolab’s competitive advantages are firmly in place.”

“Ecolab’s largest growth driver over the next decade will be the water business, which generates the majority of revenue in the industrial segment. During the quarter, water revenue grew 3% versus the prior-year quarter on an organic basis, excluding currency movements.”

—Seth Goldstein, Morningstar Strategist

“Ecolab Inc.’s diverse range of specialty chemical products includes substances classified as very high concern due to their potential harm to human health and the environment. The company is therefore exposed to increasingly strict regulations on their use, such as TSCA in the United States, where more than 50% of its production sites are located. Failure to comply could result in fines, operational disruptions and reputational damage.”

—Morningstar Sustainalytics

Agilent Technologies

Morningstar Rating: 4 Stars

Morningstar ESG Risk Rating Assessment: 4 Globes

Price/Fair Value: 0.91

Total Return Year to Date (Month-End): (5.76)

Agilent provides instruments, software and services for laboratories.

“Agilent offers differentiated technology that is protected by various intangible assets, including patents, copyrights, and trademarks. This portfolio of intellectual property and its innovation prowess in chosen fields keep competitors from directly copying its technology.”

—Julie Utterback, Morningstar Senior Equity Analyst

“The company’s business strategy, which focuses on growth through acquisitions, increases its exposure to antitrust concerns and evolving regulations across the various markets in which it operates. If it fails to adhere to relevant rules and regulations in these areas, Agilent may face potential fines, litigation or operational shutdowns.”

—Morningstar Sustainalytics

Xylem

Morningstar Rating: 3 Stars

Morningstar ESG Risk Rating Assessment: 3 Globes

Price/Fair Value: 1.07

Total Return Year to Date (Month-End): 7.43

“Xylem is one of the leading water technology companies in the world. Its extensive portfolio spans a wide range of equipment and solutions for the water industry, including the transport, treatment, testing, and efficient use of water for public utilities as well as industrial, commercial, and residential customers. Xylem operates four business segments: water infrastructure, applied water, measurement and control solutions, and water solutions and services.”

“We think Xylem has carved a narrow moat primarily due to customer switching costs and secondarily due to intangible assets. Xylem’s large installed base of equipment generates recurring revenue driven by aftermarket service and replacement parts in the water infrastructure segment, replacement parts in the applied water segment, and long-term contracts (up to 15–20 years) in the measurement and control solutions segment.”

“We have lowered our fair value estimate to $113 per share from $114 following Xylem’s third-quarter earnings release. This reflects our slightly more muted near-term revenue growth expectations, partially offset by the time value of money. Management narrowed its full-year guidance and now anticipates organic revenue growth of 5% (at the bottom end of the previous 5%-6% range) and adjusted earnings per share of $4.22-$4.24 (from $4.18-$4.28).”

—Krysztof Smalec, Morningstar Equity Analyst

“Xylem’s water infrastructure and technology solutions impact water quality and services, thereby directly influencing water ecosystems and customers’ health. Product oversight is therefore essential as any defects could lead to product recalls and costly fines and lawsuits.”

—Morningstar Sustainalytics

W.W. Grainger

Morningstar Rating: 1 Star

Morningstar ESG Risk Rating Assessment: 4 Globes

Price/Fair Value: 1.66

Total Return Year to Date (Month-End): 34.57

W.W. Grainger distributes maintenance, repair, and operations products to more than 4.5 million customers.

“We’ve raised our fair value estimate for narrow-moat-rated Grainger by 12% to $660 per share as we’ve become more confident of the firm’s ability to maintain long-term operating margin above 14%. Even so, the current stock price remains well above our revised fair value estimate.”

“Our confidence (of a narrow moat) is rooted in Grainger’s ability to fend off competitive pressures from both new and existing players in the maintenance, repair, and operations market.”

—Brian Bernard, Morningstar Senior Director

“Grainger has overall low exposure to material ESG issues primarily because it is not the original manufacturer of the products it offers. Its main exposure driver is human capital, as its diverse employee base requires several qualification competencies. Therefore, the company is vulnerable to labor relation tensions and skill deficits. Business ethics risk is another relevant exposure driver since opportunities for unethical business practices could arise to enable entrance into new markets and secure contracts and duty benefits. Regarding the environment, Grainger’s extensive logistics system exposes the company to increased shipping costs due to emerging environmental regulations.”

—Morningstar Sustainalytics

Veralto

Morningstar Rating: None

Morningstar ESG Risk Rating Assessment: 3 Globes

Total Return Year to Date (Month-End): 24.56

Veralto provides technology solutions to improve the quality and reliability of water and product innovations through a suite of brands.

“This tax-free spinoff is just the latest example of Danaher’s business pruning.”

—Julie Utterback, Morningstar Senior Equity Analyst

“Veralto’s offerings are used by private and public utilities for water analysis and treatment. Quality and safety defects could impact the health of direct consumers and the purity of water sources, and may result in liability claims, product recalls and costly customer lawsuits. In addition, regulatory standards related to the quality of drinking water supply and treatment of wastewater are strengthening in the EU, US and China. The company needs to adapt by providing innovative products that can ensure enhanced water quality and efficiency. Moreover, Veralto’s success relies on diversely skilled employees (around 16,000 as of FY2022), such as design engineers, business development managers, field service technicians, as well as production workers. Failure to attract and retain a qualified workforce could lead to skill shortages, operational delays and impact financial results.”

—Morningstar Sustainalytics

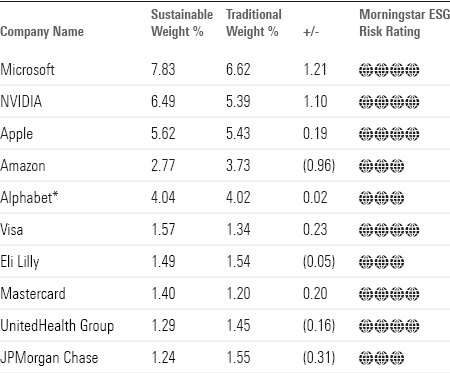

Above, we highlight the top widely held stocks between sustainable and traditional funds. Their weights in our hypothetical portfolio represent the average weights across each universe.

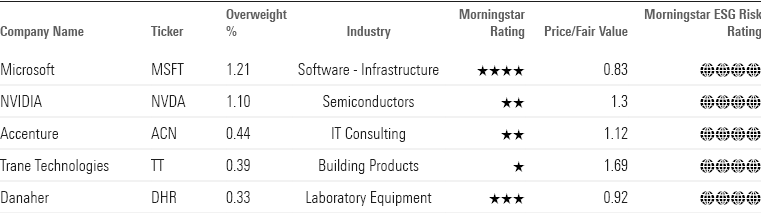

Many stocks are widely held in both sustainable and traditional funds, but a handful hold significantly more weight in sustainable portfolios. Trane Technologies TT, manufacturer of HVAC systems, and Danaher DHR, a pharmaceuticals manufacturer, make the list.