Looking from the outside in, Nvidia (NVDA), AMD (AMD), and Intel (INTC) are all strong investments to capitalize on the current semiconductor boom driven by AI. However, I’m long-term neutral on Nvidia and Intel while remaining relatively bullish on AMD. Nvidia faces an impending medium-term earnings contraction, and Intel appears undervalued only in the near term. In contrast, AMD offers more stable and high-growth potential in the coming years.

Don’t Miss our Black Friday Offers:

Nvidia Remains a Robust Investment for Now

I’m neutral on Nvidia because, despite its price increasing by 2,700% over the past five years, this growth is unlikely to last indefinitely. By 2026, the consensus estimates project annual normalized earnings per share growth to slow to 19%, compared to 120% in 2024. Furthermore, by 2028, the company may even face an earnings contraction. In fact, the consensus estimate from two analysts currently points to -0.8% earnings per share contraction in 2028.

This is because Nvidia operates in the cyclical semiconductor industry. While the company has recently benefitted from an unprecedented opportunity in AI infrastructure, semiconductor stocks historically experience sharp price increases during periods of high demand, followed by significant declines once demand tapers. This volatility is primarily due to the non-recurring nature of revenues, as they are tied mainly to hardware sales for cyclical product generations.

Based on my analysis, Nvidia stock appears to be approximately fairly valued at the moment. Considering the company is likely to experience a slowdown in growth by 2027, I applied a terminal EV-to-EBITDA multiple of 40 in my valuation model, which is notably below its five-year average of 49. Estimating that the company will achieve a full-year 2027 (or Fiscal 2028) EBITDA of $152.75 billion, I project an enterprise value of approximately $6.11 trillion by January 2028.

However, this $6.11 trillion enterprise value could significantly collapse the company’s stock price. The key variable is how the market will react to the anticipated earnings contraction. Given Nvidia’s prominence as one of the most renowned stocks globally, the market will likely price well in advance during the contraction. This dynamic is why the stock carries substantial risk over the next few years. If I owned Nvidia stock, I would prefer to exit sooner rather than later.

What Does Wall Street Say About Nvidia?

On Wall Street, Nvidia stock is currently rated as a Strong Buy, but I find it unlikely that this rating will persist through the end of 2028. The average NVDA price target is $163.26, based on 39 Buy ratings, three Hold ratings, and zero Sell ratings. This suggests an upside potential of 14.99% over the next 12 months.

AMD’s Medium-Term Growth Looks More Stable

While AMD and Nvidia have benefited from the semiconductor boom driven by AI, I’m more bullish on AMD in the long-term due to its greater diversification than Nvidia. AMD’s focus on central processing units, graphics processing units, and semi-custom solutions for gaming consoles provides more stability in future revenues than Nvidia’s core reliance on graphics processing units.

In contrast to Nvidia’s 2,700% growth over the past five years, AMD stock has risen by a more modest 250%. However, consensus estimates indicate that in 2028, AMD will likely achieve 26.5% earnings per share growth, slightly surpassing the 25.5% anticipated for 2024. Additionally, the company is projected to have a strong 2025, with the consensus earnings per share growth estimated at 54%. As a result, the near-term returns for AMD are expected to be both rewarding and sustainable.

If AMD achieves revenue of $48 billion for 2027 and maintains its current EBITDA margin of 18.5%, it will generate a 2027 EBITDA of $8.88 billion. Given that the company’s financials are expected to remain relatively sustainable for the foreseeable future, it is reasonable to assume that it will trade at a similar EV-to-EBITDA ratio to its current one. Based on this, I have applied a terminal multiple of 40 in my valuation model. Consequently, my enterprise value estimate for the company is $355.2 billion by December 2027.

The company’s current enterprise value of $223 billion implies a healthy 17% CAGR from November 2024. Furthermore, as a stock price collapse appears less likely for AMD compared to Nvidia, holding AMD beyond this 2027 estimate could be both valid and prudent for achieving sustainable long-term alpha.

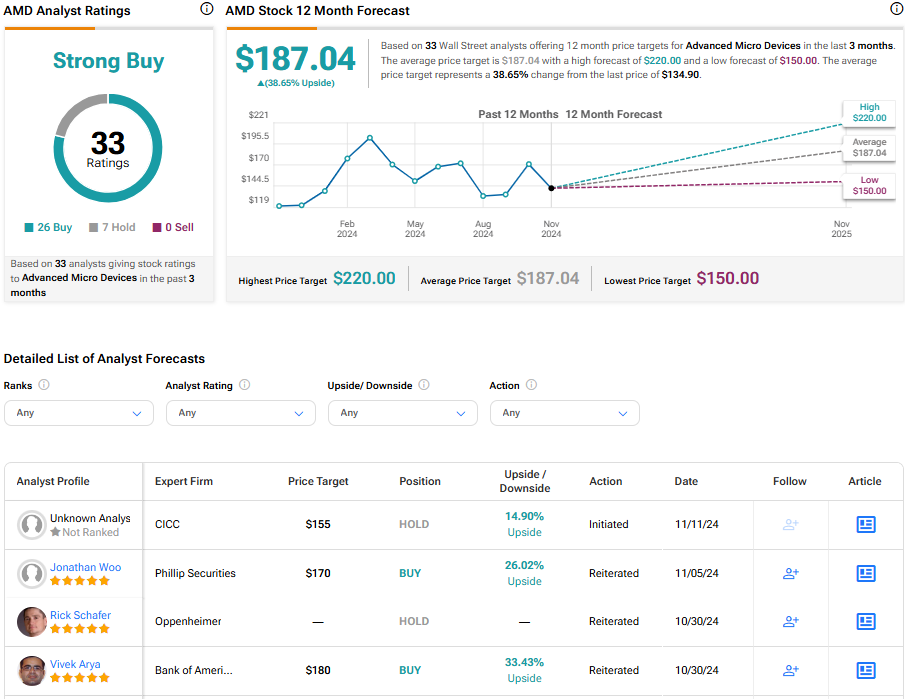

What Does Wall Street Say About AMD?

On Wall Street, AMD stock is currently rated as a Strong Buy, and I believe this rating will likely persist through 2028. The average AMD price target is $187.04, based on 26 Buy ratings, seven Hold ratings, and zero Sell ratings. This suggests an upside potential of 38.65% over the next 12 months.

Intel Is a Near-Term Value Opportunity

I’m neutral on Intel as a long-term investment because I don’t expect its growth to be exceptional. However, I’m moderately bullish on it as a near-term investment, as the stock appears moderately undervalued. Unlike Nvidia and AMD, Intel is not currently a market-leading semiconductor company. Its efforts to develop leading foundry services while simultaneously competing in chip design have faced significant near-term challenges, leading to a 15% workforce reduction aimed at improving efficiency.

The stock is currently attractive as a near-term value investment because, in 2025, consensus estimates project the company’s normalized earnings per share will increase from -$0.13 in 2024 to $0.98. This significant growth will likely result from profit harvesting following a phase of heavy investment in its foundry services.

Due to lower sentiment stemming from recent challenges in achieving profitable results during the second quarter, the stock appears moderately undervalued. Based on my analysis, the company could generate total revenues of $55.5 billion for 2025. Assuming an expanded P/S ratio of 2.25 (close to its 10-year median of 2.93) by the end of 2025—driven by increased market sentiment from the company’s profit harvesting—it would achieve a market cap of approximately $124.9 billion.

Intel’s current market cap is $106.4 billion, indicating a 17.4% 12-month return based on my estimates. However, beyond this point, I do not anticipate exceptional growth. In fact, consensus estimates for December 2027 project year-over-year normalized earnings per share growth of just 9.1%, with revenue growth of only 3.6%.

What Does Wall Street Say About Intel?

On Wall Street, Intel stock is currently rated as a Hold, with analysts maintaining a more pessimistic outlook than I do. The average INTC price target is $24.43, based on one Buy rating, 22 Hold ratings, and seven Sell ratings. This suggests an upside potential of just 0.33% over the next 12 months.

Conclusion: AMD Is the Best of the Three

If I had to choose one of these investments to buy, it would certainly be AMD. With strong growth prospects and more stable earnings and revenue than Nvidia, AMD remains well-positioned to capitalize on the current semiconductor boom thanks to its broader diversification. While Intel may appeal to near-term value investors, I believe AMD offers superior potential for both near-term and long-term returns.