Demand for battery-grade nickel is expected to surge, tripling by 2030, according to Benchmark Mineral Intelligence. This growth will largely be due to mid- and high-performance electric vehicles (EVs) in Western markets.

A senior nickel analyst at Benchmark, Jorge Uzcategui, particularly noted that:

“China will see growth too, but it won’t match the pace in ex-China regions.”

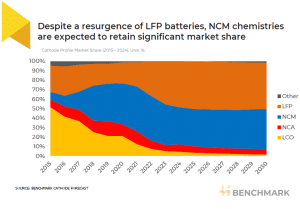

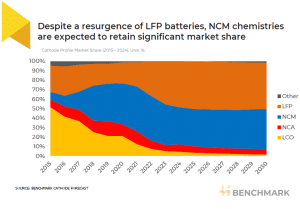

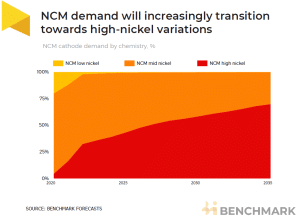

Despite lithium iron phosphate (LFP) batteries dominating the Chinese market, nickel-based chemistries are set to hold a significant share globally. Their superior performance and limited LFP supply chains outside China support this trend.

EV Sales Stall, Nickel Demand Slows

Battery nickel demand has faced setbacks in 2024 due to slower-than-expected EV sales in Western markets. Inflation and high interest rates have made EVs less competitive compared to internal combustion engine (ICE) vehicles.

This slowdown has pushed automakers to delay or revise their EV targets in Europe and North America. It has also led to gigafactory project cancellations, reducing North America’s 2030 battery supply forecast by 3% and Europe’s by 10%, according to Benchmark’s data.

China, however, has seen record EV sales, with almost 1.2 million units sold in October alone. But most of these vehicles use LFP batteries, limiting the impact on nickel demand.

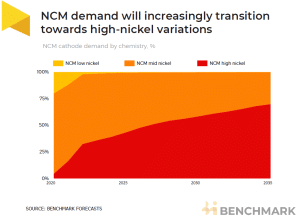

Additionally, battery producers are leaning toward mid-nickel NCM chemistries. These offer better thermal stability and reduce the risk of overheating, making them more attractive amid low cobalt and manganese prices.

Nickel Poised for a Comeback

Despite current challenges, the long-term outlook for battery nickel remains strong. Although weak demand and expanded supply have pulled nickel prices to their lowest levels since 2020, demand for battery-grade nickel is projected to grow 27% year-on-year in 2024.

Looking ahead, nickel-based chemistries are expected to dominate, capturing 85% of battery cell production capacity outside China by 2030. High-nickel chemistries will play a growing role as EV technology advances.

- Benchmark forecasts that over 50% of nickel demand growth by 2030 will come from batteries. By the end of the decade, battery nickel demand could hit 1.5 million tonnes annually.

Price Rollercoaster: Will Oversupply Keep Nickel Down?

With the projected growing demand for nickel, how about the metal’s prices?

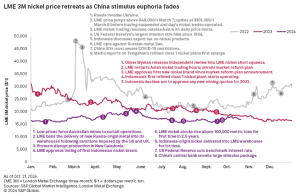

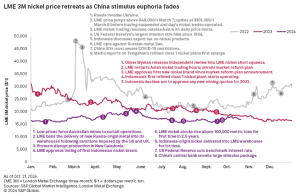

In the third quarter of 2024, nickel prices started on a downward trend. After reaching a high of $21,615 per metric ton in May, the price fell to $17,357 by July 1. In August, nickel prices hovered between $16,150 and $16,500 before climbing to $17,136 on August 27.

However, in early September, prices dropped again, reaching a low of $15,741 on September 10. This was close to the year’s lowest price of $15,668, recorded in February. Despite this, prices surged in late September, peaking at $17,698 on October 1.

Oversupply from Indonesia

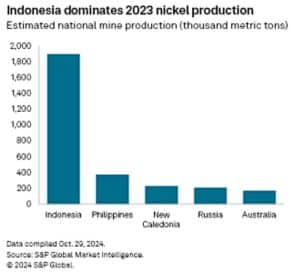

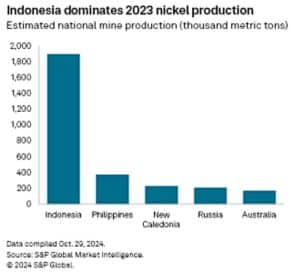

The main issue for nickel prices has been oversupply, especially from Indonesia. The country increased its mined nickel production by 99,000 metric tons in Q3. By the end of 2024, Indonesia is expected to increase production to 2.4 million metric tons, making up 57% of global output.

Indonesia has capitalized on its 2020 nickel ore export ban, drawing billions in foreign investment for its mining and EV supply chains. This strategic move has bolstered Indonesia’s dominance in the nickel market.

According to Adrian Gardner, principal analyst at Wood Mackenzie, Indonesia is set to account for 60-65% of global nickel mine production, solidifying its role as a key player in the industry. Gardner further noted that:

“We have seen on several occasions that, when Indonesia stopped or restarted ore exports and threatened to stop nickel pig iron and intermediate product exports, there was a reaction in nickel prices. The government sets the rules, and the rules are the tools.”

S&P Global Market Intelligence reveals a dramatic surge in Indonesia’s nickel ore imports from the Philippines. From January to August 2024, imports skyrocketed to 5.3 million metric tons, a massive leap from just 53,904 metric tons during the same period in 2023.

Although Indonesia dominates production, its quota system has made it difficult for Chinese smelters to secure a steady supply. This forced them to cut output temporarily. To keep up, Indonesian refiners turned to imports from the Philippines, the world’s second-largest nickel producer.

Despite relying heavily on China’s investment, Indonesia is looking to diversify its partnerships, particularly with Western countries. However, a new trade deal with China includes a $1.42 billion agreement between China’s GEM and Indonesia’s PT Vale to build a plant for processing battery-grade nickel.

Another major project involves China’s Huayou Cobalt, Ford, and PT Vale. They plan to invest $2.7 billion in a facility that will produce nickel for EV batteries.

More recently, China launched a $1.4 trillion debt swap to address its financial challenges and promote economic growth. It also plans to lower the deed tax for homebuyers to further stimulate the economy.

Challenges and Opportunities in Western Markets

In Canada, the government has committed C$46 billion to develop four EV battery plants. However, industry experts say this will require more raw materials than Canada can currently produce. The country may need up to 15 new mines to meet demand.

Europe faces its own challenges with the new Carbon Border Adjustment Mechanism (CBAM), which taxes carbon-intensive imports. Some in the steel industry argue that CBAM won’t benefit them, as it only considers direct emissions.

Meanwhile, European steelmakers are increasing their reliance on nickel pig iron imports from Indonesia. This trend has led to production cuts in Europe as they struggle to compete with cheaper imports.

What’s Next for Nickel Prices and Demand?

China will continue to play a major role in the nickel market, both in supply and demand. Although China’s EV sector grew 32% year-on-year in the first nine months of 2024, it hasn’t been enough to offset weak demand in other sectors.

Nickel prices are expected to face continued pressure in the coming years due to a surplus. With a 5.8% annual growth rate in supply projected through 2028, producers may struggle to restart operations as prices remain flat.

Investors should closely watch developments in China and Western markets, as they will heavily influence nickel’s future. While short-term hurdles exist, battery nickel demand is poised for long-term growth. As EV adoption rises globally, nickel’s role in the energy transition will only strengthen.

Disclosure: Owners, members, directors, and employees of carboncredits.com have/may have stock or option positions in any of the companies mentioned: AEMC.

Carboncredits.com receives compensation for this publication and has a business relationship with any company whose stock(s) is/are mentioned in this article.

Additional disclosure: This communication serves the sole purpose of adding value to the research process and is for information only. Please do your own due diligence. Every investment in securities mentioned in publications of carboncredits.com involves risks that could lead to a total loss of the invested capital.