From metals to mining, energy to electricity, and transport to transmission, every sector is pivoting toward sustainability. The automotive market has already adopted renewable solutions, and one such is Electric Vehicles (EVs), which are playing a significant role in combating transport emissions.

Recent data shows EV sales skyrocketed from under a million in 2012 to about 14 million in 2023. This rapid growth indicates a reduction in oil consumption and a shift toward cleaner energy options for road transportation.

Despite this seemingly impressive EV boom, they currently make up less than 2% of the total global vehicle fleet, according to the International Energy Forum’s (IEF) latest report. This percentage shows there’s ample scope for EV expansion in the future.

At the same time, it leaves one wondering if the EV momentum is slowing down or will pick up space in the coming years. Let’s analyze it here…

Projected EV Sales: Regional Disparities

We discovered from the BloombergNEF report that EV sales including battery-electric and plug-in hybrid vehicles can spike up to 16.7 million units this year but was 13.9 million in 2023.

However, global EV penetration will be unevenly distributed and will vary region-wise.

source: S&P Global

China

The report further revealed China has captured the global EV market, claiming six out of every ten plug-in vehicle sales worldwide this year. The EV share of domestic car sales was more than 50%, with September alone seeing a nearly 50% surge in sales.

However, Chinese EV sales mainly came from plug-in hybrids and range-extended EVs, rather than battery-electric vehicles (BEVs) that fueled earlier growth. Notably, retail BEV sales in China have grown by 18% this year, while overall plug-in vehicle sales have climbed 37%.

From this data, we can infer that EV sales are not slowing down in China. But this can put pressure on international automakers with stiff competition.

The U.S.

Bloomberg reported that the US EV market is far behind that of Europe and China but hit a high in the third quarter, with around 390,000 vehicles sold.

They further reported that while Tesla’s market share has declined this year, dropping below 50% of all EVs sold in the US, other automakers have stepped up. Companies like GM and Hyundai have significantly increased their sales which made up for Tesla’s slowdown and added a spark to the industry.

On the other hand, media reports say that the EV industry experienced this sudden jerk after President Donald Trump planned to end the consumer tax credit for electric vehicles. Rivian Automotive, Lucid, GM Motors, and Ford Motor joined the fleet, experiencing a sharp stock drop.

Japan and EU

Japan and Germany despite being the major hubs for the largest automotive brands have not only experienced a market slowdown but a massive decline in EV sales.

Several media agencies reported on the challenges for electric vehicles in the European market for a considerable period. This is mainly because of the highly-priced EV models in the market and the pricing system.

BNEF’s head of advanced transport, Colin McKerracher, described gauging the current EV demand in Europe as “complicated”. He commented,

“Automakers are holding off launching more affordable EV models until 2025 when vehicle CO2 targets across the bloc toughen again. They are trying to recoup the full development costs of their EV platforms across relatively low sales volumes.”

He also added that they are likely to see “history” repeat in Europe, with automakers prepping more affordable models like the new Renault 5, Hyundai Inster, Fiat Grande Panda, Skoda Epiq, and VW ID2.all.

Germany experienced a sharp 61% drop in EV sales in August, raising concerns at first glance. However, the decline isn’t as alarming as it seems. In August 2023, a rush to buy EVs before a subsidy cut caused a significant spike in sales, creating an inflated baseline for year-over-year comparisons. This pull-forward effect distorted the figures, making the 2024 drop appear more dramatic than it is.

Who’s Ahead in Global EV Adoption?

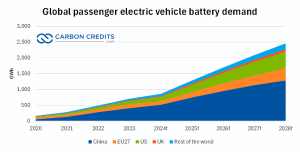

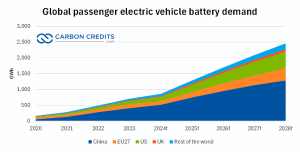

EV penetration is set to grow significantly worldwide. The Internation Energy Forum stressed on the following data:

- IEA projected, that the number of EVs per 1,000 people will rise from less than 1% in 2020 to 28% by 2035 globally.

- China leads with a projected 57% EV adoption among passenger cars by 2035 while the U.S. and EU will reach 30% and 28%, respectively.

Once again China is driving the surge in demand where EVs can cover 70% of road transport within a decade. In contrast, regions like Asia, the Middle East, Africa, and South America show slower adoption. By 2035, EV penetration in these areas will remain around 8% under the IEA’s Stated Policies Scenario. The disparity highlights uneven progress in electric mobility and the challenges for global emissions reduction goals.

The data reveals that there’s a slower pace of EV adoption in developing regions. This highlights the need for supportive policies and better access to sustainable transport solutions.

Electric Vehicle penetration per 1,000 inhabitants

source: International Energy Forum Report 2024

Removing Trade Hurdles for a Greener EV Future

The rapid increase in EV production relies on a robust critical minerals supply chain like lithium, cobalt, and nickel. As we have seen, these materials are essential for manufacturing EV batteries, motors, and renewable energy storage systems.

Imposing trade restrictions on EVs, batteries, and critical minerals creates challenges for adopting clean technologies. It also creates significant delays in the EV manufacturing process.

Even though such policies may support domestic EV growth they come with risks. For example, tariffs on EVs and essential components increase costs for both manufacturers and consumers. Higher costs subsequently make it difficult for countries to deploy cost-effective solutions. If consumerism decreases then delay in progress to achieve climate goals is inevitable.

source: S&P Global

Thus, minimizing barriers in the supply chain is crucial for maintaining a balance in electric vehicle supply and demand. Moreover, governments and industries must work together to streamline trade and avoid complex policies that could disrupt this progress. Once EVs continue to dominate the mobility sector, reliance on fossil fuels will automatically wean off.

Content Sources:

- Transportation and Mobility Energy Demand Outlook Report

- Are Global EV Sales Really Slowing Down? | BloombergNEF