(Bloomberg) — Bond traders are once again ramping up wagers on a half-point interest-rate cut by the Federal Reserve next week, just days after that bet seemed all-but-over.

Most Read from Bloomberg

The likelihood of a 50-basis-point move climbed to 40% on Friday, up from as low as 4% earlier in the week. The repricing added to a rally in US government bonds, lifted small-cap stocks and weighed on the dollar.

This shift marks a rapid about-face for traders who earlier this week had almost completely discounted the possibility of a large cut in the wake of hotter-than-forecast consumer-prices data and signs the US labor market remains relatively robust. The trigger for the revision was a Wall Street Journal report Thursday that Fed policymakers were considering whether to reduce rates by a regular quarter point, or opt for half a percentage point.

The debate over the size of the Fed’s first rate cut this cycle has captivated markets for weeks. But with time running out before the Fed’s Sept. 17-18 meeting, the stage is set for a volatile few days as traders attempt to gauge whether they are adequately positioned for either a quarter- or half-point move, and how the few remaining data points — including August retail sales on Tuesday — will factor into the Fed’s thinking.

“If the Fed cuts by 25 basis points next week, they are putting themselves behind the curve,” said Bryan Whalen, chief investment officer at The TCW Group. He said momentum for a half-point cut next week will increase should retail sales data show unexpected weakness. “If they only do 25, that’s more bullish for bonds because it means the Fed will have to be more reactive down the road.”

The chief US economist at JPMorgan Chase & Co. Friday reiterated its call for a half-point cut next week — leading to a volume surge in fed funds futures that would benefit from that outcome. JPMorgan is the lone large Wall Street bank forecasting a half-point rather than a quarter-point cut. Citigroup Inc. had the same forecast until Wednesday, when August consumer prices data prompted a revision.

While acknowledging the possibility of a smaller cut, “we’re sticking with our call that they will do the ‘right thing’ and cut 50bp,” JPMorgan’s Michael Feroli said in a report.

Amid Friday’s tussle between traders calling for a large cut now and those seeing a more gradual path, the swaps market briefly priced in cuts of 75 basis points by the November meeting, implying one half-point move over the next two decisions.

Yet activity in the futures market painted a slightly different picture; there, sellers emerged to fade a rally in contracts that cover next week’s policy meeting, suggesting some hesitation to push the chance of a large cut beyond 40%. And Thursday’s trading indicated traders quickly covering wagers on a quarter-point move now that the prospect of a bigger cut is once again on the table.

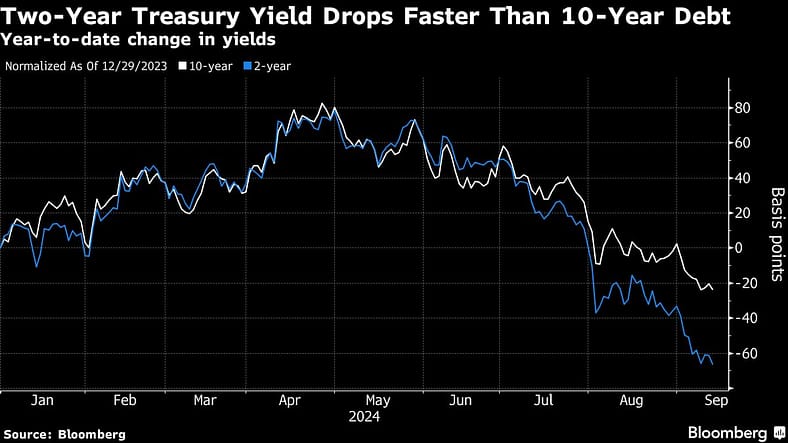

After paring their advance in tandem with the move in futures, Treasuries resumed rising, sending yields back toward session lows. The policy sensitive two-year yield fell 6 basis points to 3.58% while the 10-year fell 2 basis points to 3.65%, exceeding the two-year by the widest margin since July 2022. The yield curve has normalized over the past week, ending a more than two-year inversion — a record stretch for this measure — as the prospect of more aggressive Fed cuts boosts short-dated Treasuries more than their longer-dated counterparts.

US equities advanced led by smaller-company shares, which have tended to outperform when investor expectations for Fed rate cuts rise. Those companies, along with other cohorts such as profitless tech, disproportionately benefit from lower borrowing costs as many have variable-rate debt.

The dollar, meanwhile, weakened versus most of its 10 major peers.

“If Powell wants 50, they will go; the other members of the Fed will jump on board,” said Gregory Faranello, head of US rates trading and strategy for AmeriVet Securities. Citing the current Fed policy rate of 5.25% to 5.5%, “they are a hundred basis points too high,” he added.

Speaking Friday in Singapore, former New York Fed President William Dudley, a Bloomberg Opinion columnist and adviser, and chair of the Bretton Woods Committee said there was “a strong case for 50. I know what I’d be pushing for.”

The case for easing has been building for some time now. The central bank’s favored gauge of inflation has retreated toward its longer-term target of 2% from a high of over 7% two years ago. Disappointing US data releases, including a surprise drop in jobs openings, have further supported calls for Fed cuts.

What Bloomberg Economists Say:

“CPI and PPI data for August suggest the Fed’s preferred inflation gauge — the core PCE deflator, due out Sept. 27 — will likely remain steady at 0.16%. Not only will officials take that as a green light to start cutting rates this month, it could even keep a 50-bp cut on the table. Still, absent a clear signal from the Fed of a jumbo rate cut, our baseline is slightly in favor of a 25-bp move in September.”

— Estelle Ou, economist and Anna Wong, chief US economist

But others worry that a half-point cut by the Fed next week would be an over reaction, and that the economy is not in urgent need of looser monetary policy.

“The market is a bit ahead of itself,” said Mark Dowding, the CIO at RBC BlueBay, who said the Fed is likely to to reduce rates gradually, starting with a 25-basis-point cut. “From our perspective, it looks like the economy is doing fine.”

–With assistance from Masaki Kondo, David Finnerty, Alice Gledhill, Anchalee Worrachate, Aline Oyamada and Jeremy Herron.

(Adds JPMorgan comments and updates yield levels.)

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.