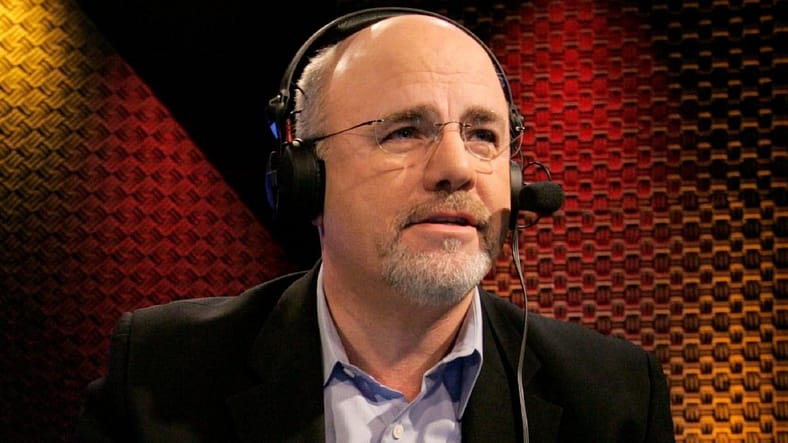

Dave Ramsey is one of the most popular financial advisors in America. His investment philosophy focuses on getting people out of debt and into low-risk assets that reliably build wealth over time.

But what does that mean in practice? If you want to follow Ramsey’s philosophy, which assets should you own? You can start by considering whether three of his favorite investments fit your financial plan, based on a short YouTube video by Ramsey and summarized below.

Be Aware: I’m a Financial Advisor: 6 Steps To Take If You Have $1,000 To Invest

Discover Next: 6 Subtly Genius Moves All Wealthy People Make With Their Money

Earning passive income doesn’t need to be difficult. You can start this week.

Business(es)

Much of Ramsey’s wealth is concentrated in his financial advisory business, Ramsey Solutions. An estimate by Ramsey suggests the company brings in about $300 million in annual revenue.

The popular financial advisor hasn’t shared the exact amount of wealth he’s invested in his businesses. But generally, high-net-worth individuals hold about 41% of their assets in companies, according to the Federal Reserve System.

Ramsey invests in his business because it enables him to earn more money. For the average person, that could mean investing in a car to start driving for a ride-sharing service. Or you might spend money to build an online store to sell crafts you make.

If you’re considering investing in a personal business, chart a course toward profitability first. Remember, Ramsey holds wealth in his company only because it earns him money. You don’t want to push a lot of cash into a startup if you have only a vague sense of how it will become profitable.

Explore More: 5 Ways To Pick Your Next Investment, According to Experts

Debt-Free Real Estate

Ramsey is also a big fan of investing in real estate. However, he used leverage in this market when he was younger and went bankrupt as a result. Today, Ramsey still believes in real estate investments, but he no longer uses debt to make those purchases.

That’s a different philosophy from someone like Rich Dad’s Robert Kiyosaki, who uses “debt as money,” according to Fortune. In other words, he uses mortgages as a tool to gain more exposure to real estate markets he likes. The risk in this approach is that you can lose everything, as Ramsey did, when market conditions turn for the worse.

That being said, there are ways to invest in real estate without buying a property outright. For example, you can purchase shares in something like a real estate investment trust. This gives you exposure to a broad portfolio of properties without requiring much upfront cash.

Mutual Funds

Finally, Ramsey is a big believer in mutual funds and exchange-traded funds. These track the performance of broad market segments, like the S&P 500. Warren Buffett also recommends investing in these, as we’ve previously reported on.

The reason? The stock market, as a whole, has reliably gone up over time, according to the investment research platform, MacroTrends. Even though it can decrease from year to year, the long-term trend is strong. Ramsey and Buffett recommend passively investing in these funds. This means you buy shares at a set interval, such as every month, regardless of where the price goes.

For example, you might put $100 into the S&P 500 monthly. You would do that regardless of whether the market is up 10% on the year or down 30%. The idea is that over time, your wealth will grow — as long as you keep at it.

The amount of money you invest each month will depend on your budget and where you’re at in your financial journey. For example, Ramsey said you should save three-to-six months’ worth of expenses in an emergency fund before investing for retirement.

More From GOBankingRates

This article originally appeared on GOBankingRates.com: Dave Ramsey: The Only 3 Investments He Has